On the scale of disasters that can befall investors, being left holding shares in a company that goes bankrupt is one of the most gut wrenching.

Regulators and market operators generally hold quoted companies to high standards. They have to abide by well-documented codes of financial reporting and governance. But there’s no escaping the fact that some do occasionally collapse - sometimes with very little warning.

Rules and outcomes of bankruptcy arrangements differ from country to country. But for regular equity holders, the losses are typically painful and permanent. They’re usually at the back of the queue when administrators are shaking whatever value is left from the remains of a broken business. That can mean the value of your investment literally ‘going to zero’.

Bankruptcies are generally infrequent, but when they do happen it can be for a host of often-connected reasons. Dramatic changes in economic conditions, industry dynamics or aggressive competitors are all classic reasons. But so too are poor management, weak strategy, faulty business models, bad capital allocation and excessive debt.

Good investment research usually explores all the things that might go wrong with a company - as well as all the things that might go right. But the human bias for optimism means that it’s easy to explain-away nagging warning signs.

Given that bankruptcies can seemingly come out of nowhere - and be caused by any number of reasons - what can you do to try and see the red flags before they end up losing you money?

A checklist for avoiding trouble

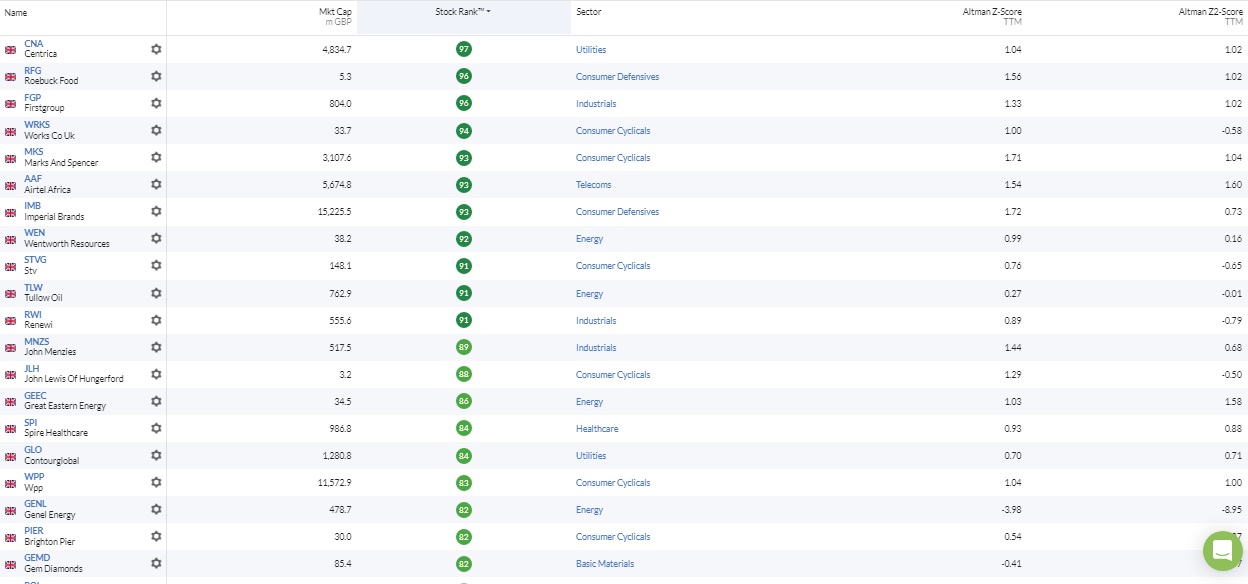

An answer to this question lies in the work of a finance academic called Edward Altman, who first examined it back in the late 1960s. In fact, his work was among the first properly scientific studies of what makes firms go bust since America’s Great Depression in the mid 1930s. It was only at that time that the data and computing power was available to undertake it.

Despite the fact this research dates back more than 50 years, it’s still regarded as one of the most insightful checklists of its type - and Altman remains an influential figure. It’s still very much in use in investment strategies deployed by investment banks and fund managers to identify weak (and strong) balance sheets.

Components of the Z-Score

Professor Altman devised what’s called the Z-Score. It’s a series of five accounts-based tests that…