Hunting for investing ideas in a market collapse caused by an unquantifiable threat seems like trying to catch a falling knife. It’s certainly true that many investors will be feeling a lot of pain right now. And the haze of uncertainty looks set to be around for some time yet.

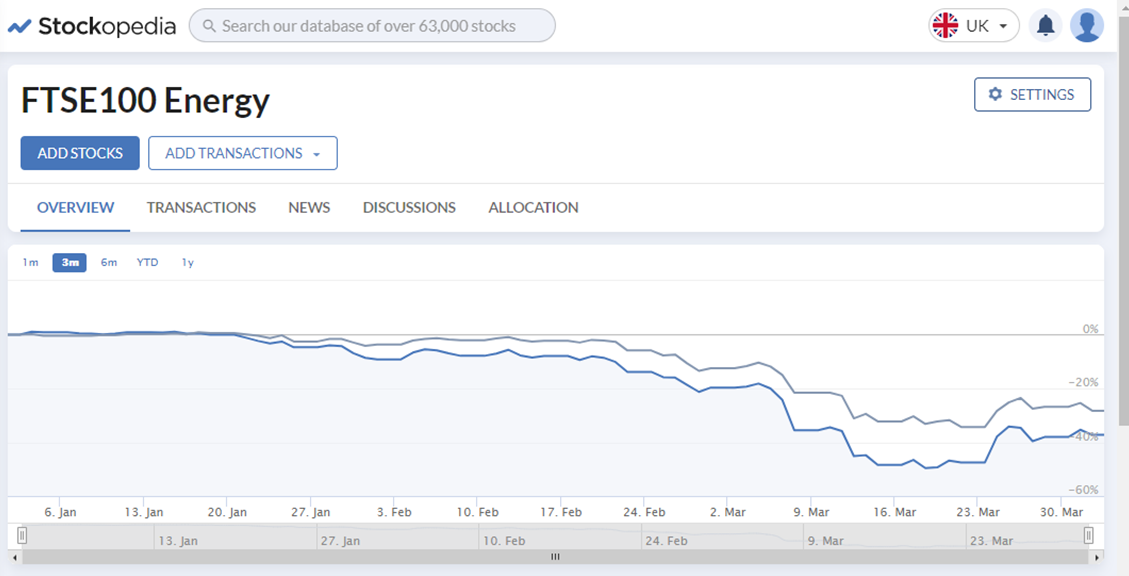

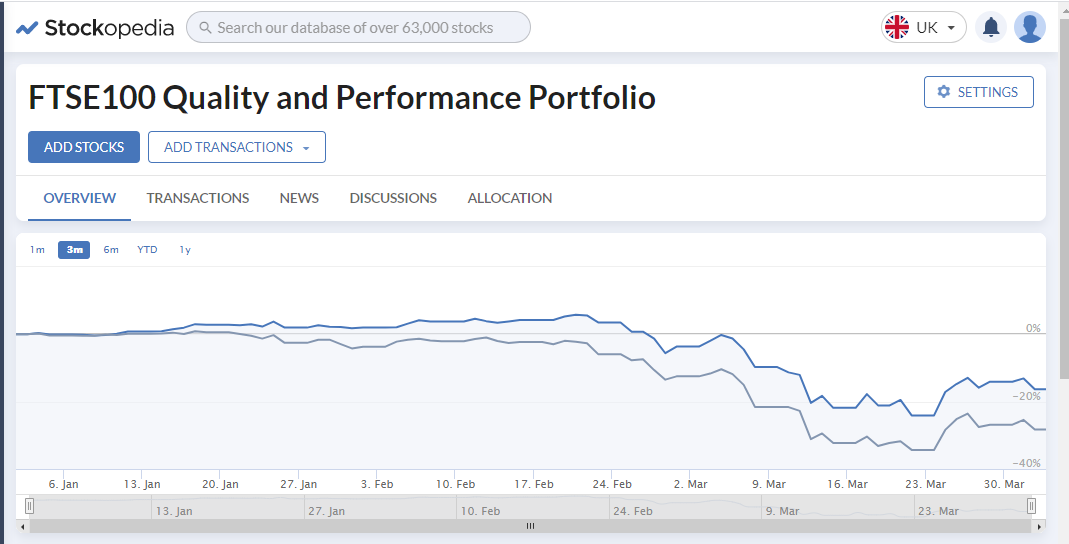

In these severe market conditions, no share has been left untouched. In a period of fear - where future earnings have suddenly become pretty unknowable - prices have been marked down across the board.

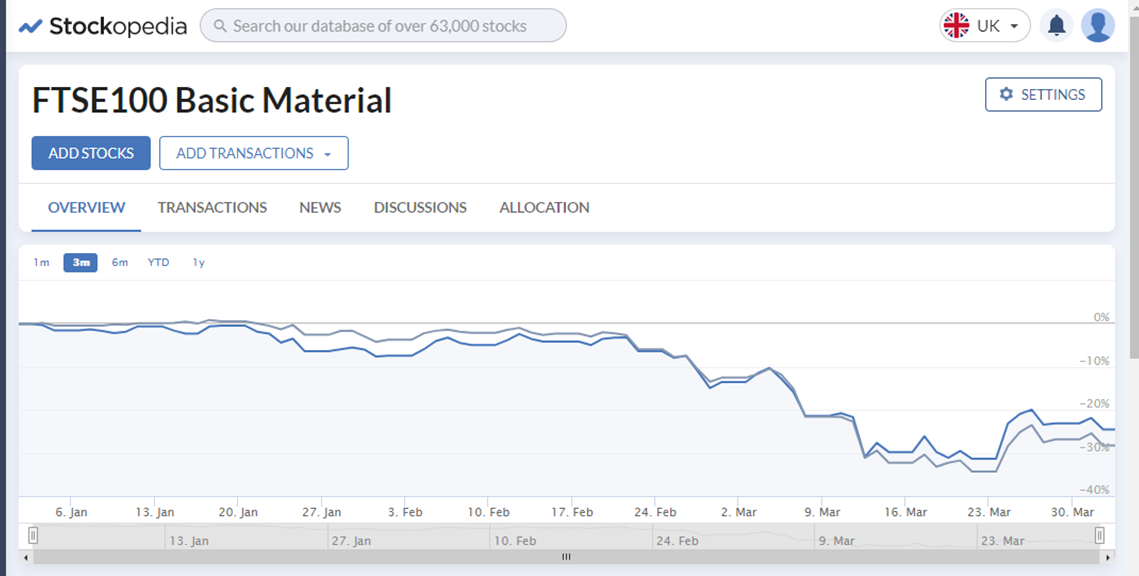

Unsurprisingly, there haven’t been many positives to take from this experience. But one observation is that defensive, high yielding large-caps have held up reasonably well in a tumbling market - and their yields have been rising.

In normal conditions, these are seen as some of the most dependable, if unexciting shares in the market. They’re the equity equivalent of a safe option; large, mature businesses that reliably serve their markets in good times and bad. What they can’t offer in spectacular price gains they make up with stable dividends on decent yields.

These are the income hunter’s core holdings, the cornerstone stocks that can live in portfolios for years. And while the appetite to buy now - when so much uncertainty persists - may be hard to find, there are reasons why these stocks hold appeal.

Using a few simple screening rules, it’s possible to work up a list of the market’s large-cap high-yielders in defensive sectors. Those rules include:

- Large caps

- Shares in consumer defensives, utilities and healthcare industries

- Low historic volatility (Balanced and Conservative Risk Ratings)

- Sorted by forecast yield

Name | Risk Rating | Forecast Yield (1 month ago) | Forecast Yield % | Relative Strength % 1 month | Sector |

Balanced | 6.6 | 8.1 | +18.3 | ||

Balanced | 4.9 | 6.2 | +16.6 | ||

Balanced | 5.2 | 5.6 | +35.7 | ||

Conservative | 4.8 | 5.3 | +31.0 | ||

Balanced | 4.0 | 5.3 | +9.7 | ||

Conservative | 4.8 | 5.3 | +32.8 | ||

Conservative | 4.9 | 5.1 | +44.5 | ||

Balanced | 4.1 | 4.8 | +28.2 | ||

Balanced | 3.9 | 4.2 | +36.0 | ||

Balanced | 3.6 | 4.1 | +28.6 |

You can see that shares passing these rules have all seen their yields rise over the past month. But these low-volatility defensive blue chips have also held up well against the market based on 1-month relative price strength. They’ve not been immune from price pressure, but they have withstood a lot of the volatility and done much better than the market average. This is why these kinds…