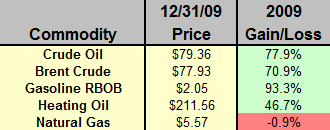

The success of investors who plowed money into energy ETFs and ETNs last year was highly dependent upon which investment vehicles they chose, a point that should be clear after looking at the right-most column in the graphic below.

For example, an investment in a crude oil-only offering on December 31st, 2008 would have resulted in gains anywhere from 11 percent to 43 percent, however, both of these trail the 78 percent gain of the underlying commodity in what must have been an unpleasant surprise for at least a few investors who compared the two at year-end.

not include any dividends paid unless reflected in the "Adjusted Closing Price" at Yahoo! Finance.]

Predictable roll periods (i.e., when a fund manager replaces expiring futures contracts) combined with a wicked contango (i.e., when the purchase of new futures contracts costs more than the expiring ones can be sold for) to severely hamper investment returns for all energy ETFs, however, some were affected far more than others.

For crude oil, the PowerShares crew seem to have things figured out via their flexible futures contract replacement strategy for both the PowerShares DB Oil ETF (NYSEArca:DBO) and the PowerShares DB Energy ETF (NYSEArca:DBE) that gained 42.9 percent and 30.4 percent, respectively. Other funds weren't half as good ... literally.

It was even worse for those who ventured into the natural gas market through either of the natural gas-only offerings.

Even though the price of natural gas futures declined less than one percent last year, the United States Natural Gas ETF (NYSEArca:UNG) ended the year down 56.5 percent and the iPath ETN wasn't much better.

Gasoline was clearly the place to be last year as the underlying commodity rose 93.3 percent while the United States Gasoline ETF (NYSEArca:UGA) - the only gasoline-only ETF available -gained an impressive 88 percent.

Three ETFs from the table were shut down in 2009, the paired MacroShares funds along with the wildly popular PowerShares Crude Oil Double Long ETN (NYSEArca:DXO) that was the victim of a "regulatory event" related to the new found zeal of the CFTC (CommodityFutures Trading Commission) at regulating commodity markets.

Overall,…