We’re closing in fast on the end of January (a month that has seen the FTSE and AIM All Share markets rally 3.4% and 2.4% respectively) and we’re perhaps ready to put the pain of 2022 behind us. But our annual subscriber survey results are in and - as always - our community has provided us with some interesting insights which we can all learn from.

So let’s return for a moment to 2022 - a year which started with a hint of uncertainty for Britain’s (and the world’s) continued economic recovery post-Covid, flew through a crisis in the bond market and ended (as last week’s retail figures have now confirmed) with the worst month for consumer spending since ONS records began. ‘Energy crisis’, ‘inflation’ and ‘interest rate’ have become market buzzwords and they’ve had a far stronger impact than the buzzwords that they have replaced: ‘lockdown’, ‘deficit’ and ‘bubble’. The FTSE All Share started the year at 4100 points and fell to a low of 3712 in October. AIM fared rather worse, down almost a third from its January peak to its October trough.

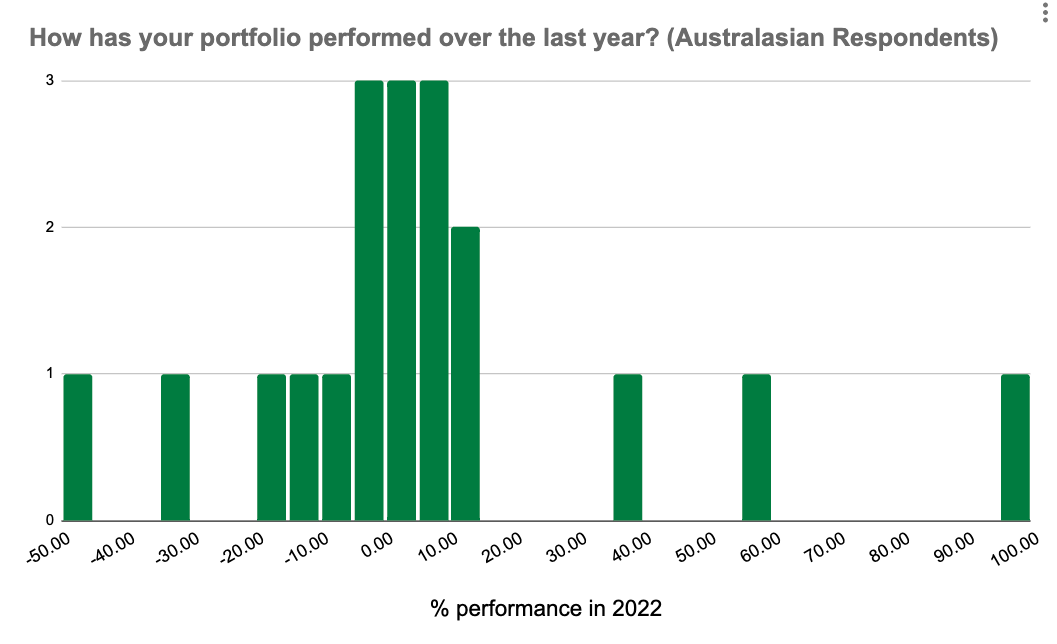

How did you hold up?

Not too badly, all things considered, as the chart below shows.

The 903 subscribers who responded to our survey reported a median performance of -9% in 2022. Almost a third of you ended the year with your portfolio in positive territory, with eight respondents managing to more than double their money. The most common performance ‘bracket’ was -10% to -20% with almost all respondents falling somewhere in the region of -30% to +30%. And only 6% of you had to endure a portfolio which underperformed AIM.

When we compare that to some of the returns of renowned fund managers, that’s not a bad performance at all. And considering you’d have had to have been overweight in the energy sector at the start of the year to have outperformed the FTSE (more on that below), there is a lot of comfort to be taken in these numbers.

5 of the worst performing funds in 2022 | ||

Fund | Category | 2022 Return |

Morgan Stanley US Growth Fund | US Large-Cap Growth | −55.98 |

Baillie Gifford Long-Term Global Growth | Global Large-Cap Growth | −40.42 |

Jupiter UK Mid Cap | UK Mid-Cap | −40.12 |

Jupiter UK Small Company Focus | UK Small-Cap | −39.18 |

Baillie Gifford Global Discovery | Global Small/Mid-Cap | |