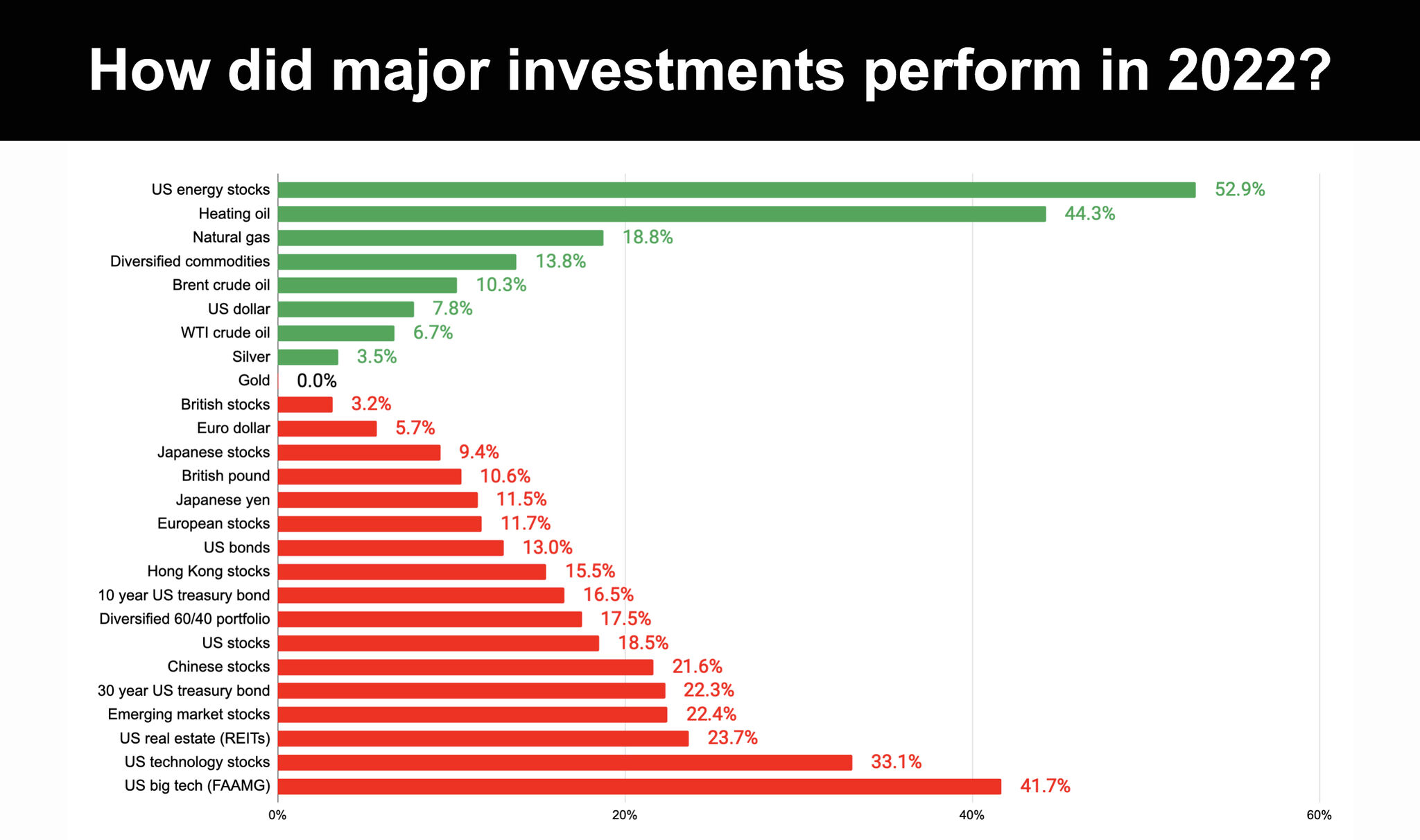

Well, hopefully a lot better than last year (see below)!

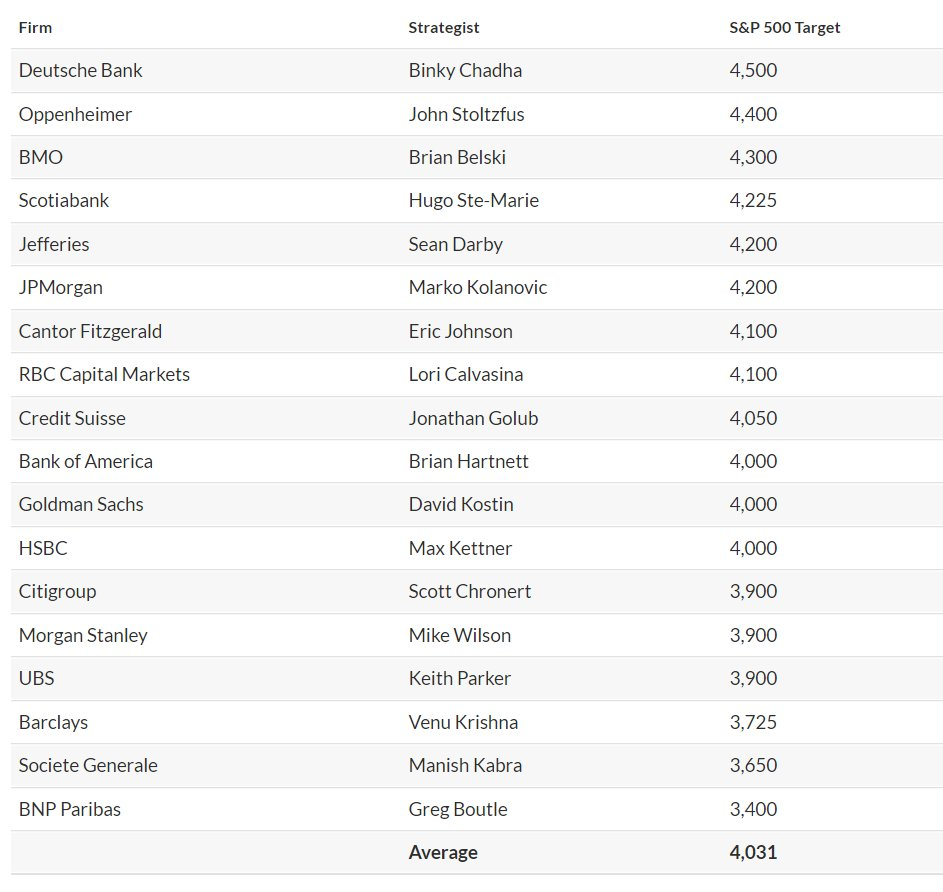

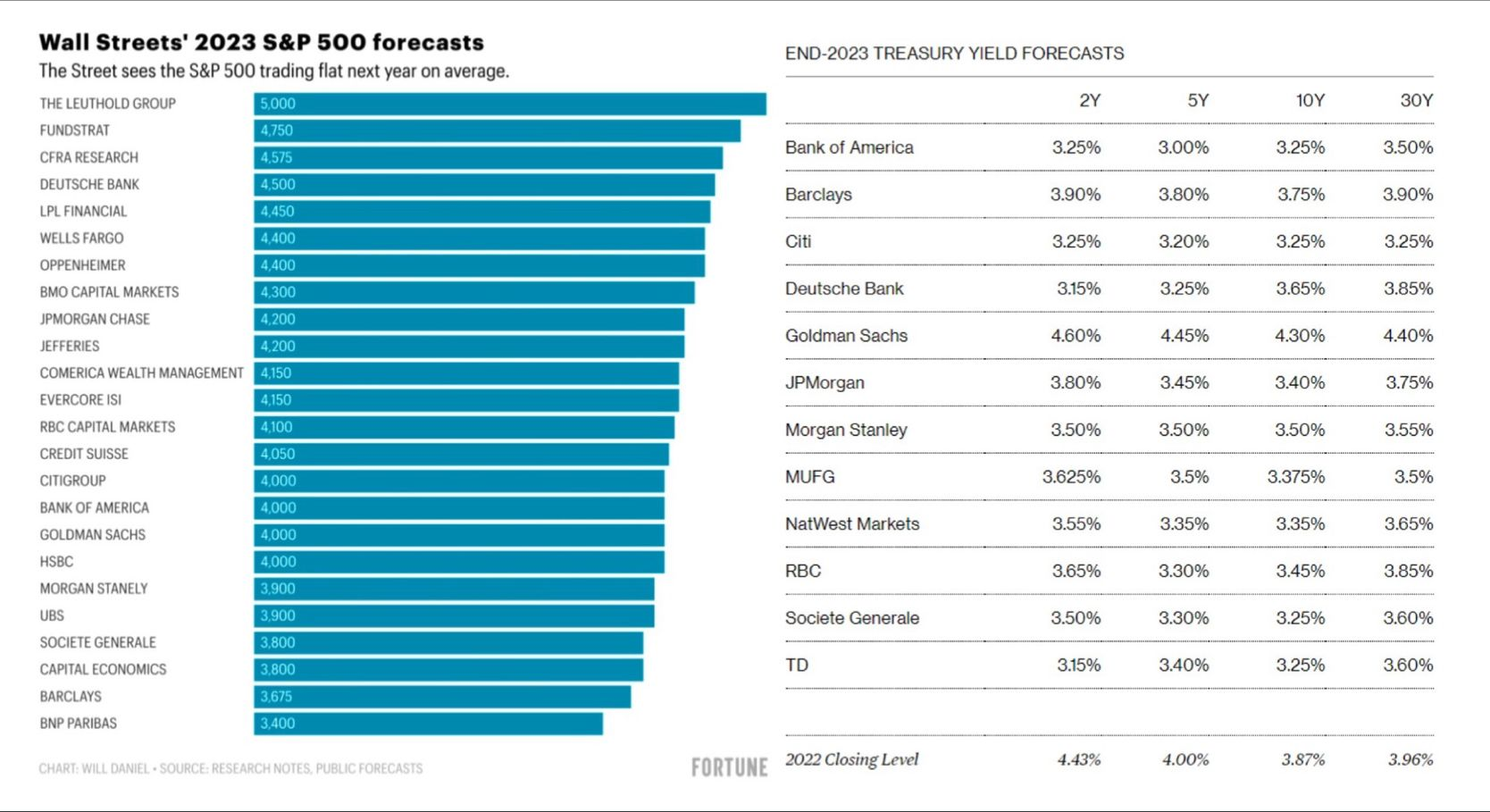

Indeed according to the experts on Wall Street (see below), the S&P500 will end 2023 either up 30% at 5,000, or down >10% to 3,400. Or in other words, another total dice shake!

Here Uber Bull Tom Lee of Fundstrat opts for 4,750 based on US CPI falling faster than expected. Whilst BNP Paribas' Greg Boutle suggests 3,400.

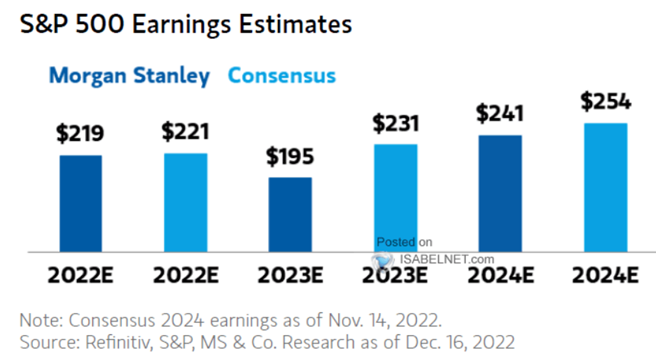

In the middle, Morgan Stanley's equity guru Mike Wilson reckons S&P500 FY'23 earnings will drop >10% to $195/share (vs $220 in FY22), with the index dipping below 3,300 in Q1'23 vs 3,840 today (-15%). Albeit then creating a “terrific buying opportunity" & rebounding strongly to 3,900 by yearend.

To me, it's be all about happens in 2024.

In the event corporate profits can recover to between $240-$250/share. Then on a forward 17x PER, the S&P500 would theoretically exit 2023 at around 4,165 - or 8% higher than today.

Reasonable but nothing to shout about. Especially given a 1 year US Treasury Bill currently pays out a risk-free 4.7% return - representing a hypothetical equity risk premium of 3.3%.