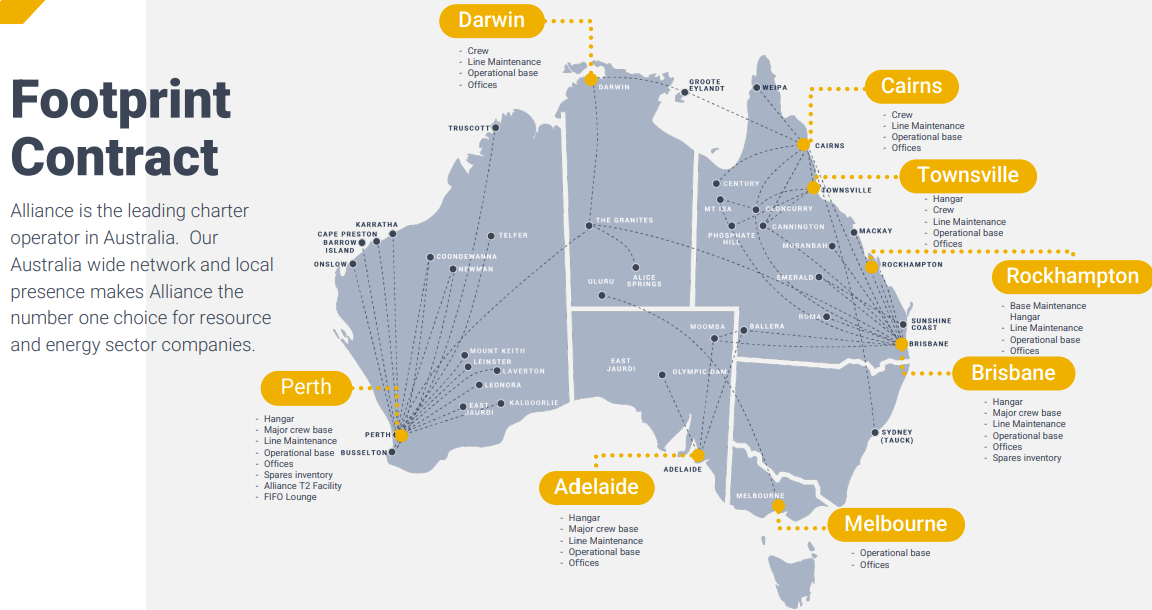

Alliance Aviation Services (ASX:AQZ) is an airline business with a very different business model to the other commercial carriers. They own and operate a fleet of aircraft, but only 3.4% of their revenue comes from operating regular public transport flights. Their largest source of revenue is contract revenue. This is typically in the form of contracts with mining companies where they fly mining staff from the major ports to remote mining locations. These are known as fly-in-fly-out (FIFO) workers. Their strategic goal is to be a wholesaler of aircraft capacity and therefore they are continuing to reduce their regular public transport flights.

Source: Alliance Aviation Services Limited, “Results Presentation 1H FY2023”, 8/2/2023

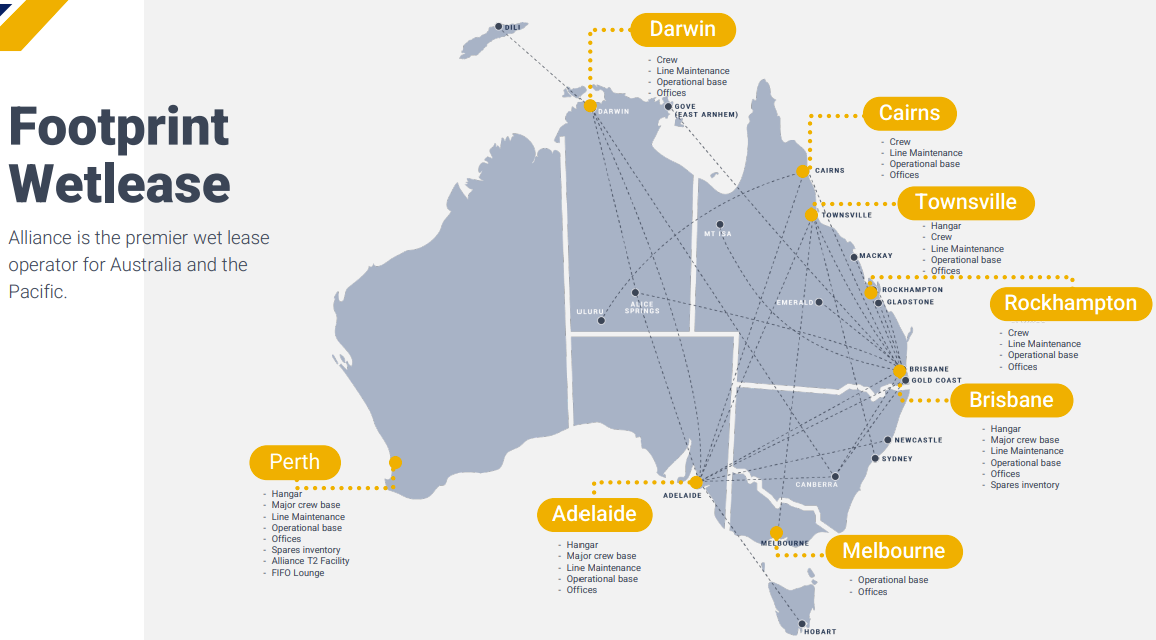

Their second largest source of revenue is through wet lease agreements. This is where Alliance own the aircraft but lease them to Qantas Airways (ASX:QAN) and Virgin. In addition to providing aircraft capacity, they also provide the staff, and take care of all aspects of servicing the aircraft. Revenue from this segment increased by 316% in the most recent half with six new aircraft being deployed.

Source: Alliance Aviation Services Limited, “Results Presentation 1H FY2023”, 8/2/2023

In addition to regular public transport flights, they also derive a small amount of revenue from two other segments, but these are declining. They are charter flights and aviation services.

Total revenue for Alliance has been rising strongly since 2017 with a CAGR of 13.1%. This accelerated rapidly in the first half of 2023 with growth of 40% largely driven by the expansion of the wet leasing component of the business. Revenue for the whole of FY23 is forecasted to grow by 42% with further growth forecast for FY24. (Note: These forecasts are the average of the four market analysts who cover the stock.)

Profits have generally been rising but fell in 2022. Underlying profits fell due to the challenges associated with COVID. The statutory profit actually fell into a loss, driven down by a $12.1 million write down of the older Fokker 50 fleet which are being retired. Profits are forecast to rebound strongly in FY23.

Alliance ranks highly in terms of Quality with a score of 89. This is supported by a good Health Trend score of 7/9 but dragged down a bit by lower Return…