While I find the screening tools, portfolios and other features that Stockopedia provides incredibly useful, most of my time on the site is spent looking at the StockReports of individual companies. There is a reason for this; it gives me an investing edge.

One of the challenges of investing in the modern age is the sheer amount of information available to investors. This is completely different from when some of the best-known investors, such as Benjamin Graham, were forging careers. In the past, access to information was a problem, and investors had to register to receive annual reports in the post or pay for a published book that summarised the accounts. Knowledge was power. In the age of the internet and social media, ideas come to us thick and fast. Even for full-time investors, there is a limit to the number of companies that one can research. It is, therefore, vital that investors are able to quickly determine whether a company is worthy of further research. Today, the ability to quickly parse knowledge is power, and that is what the StockReport gives me.

My approach

Whether ideas are generated by one of my Stockopedia Stock Screens, mentioned by a friend, or the company is presenting at an investor event, my approach tends to be the same:

Valuation

I tend to look for cheap stocks. It can be tempting to just look at the Value Rank, which is an amalgamation of many different metrics. However, I think this approach is probably too simple. The typical value opportunities are split into two types: asset plays and earnings ones.

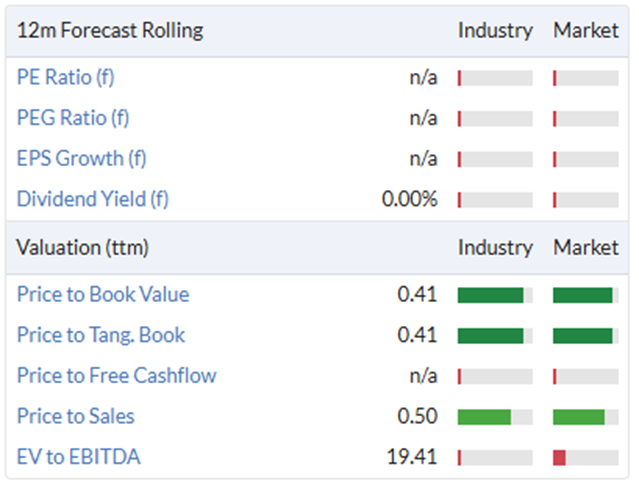

When investing in a company that is cheap on assets, I often look at that metric alone. For example, when I look at the StockReport of Camellia (LON:CAM) , most of the metrics are terrible:

However, the Price to Tangible Book is among the lowest on the market. For me, this makes the company interesting to research further. At this point, the rest of the StockReport isn't necessarily helpful. Instead, I will want to look at what those assets are and get an idea of how committed management is to making those assets productive again (or selling them to someone who will.) However, the StockReport has already done its job, flagging an interesting idea for further research.

For most stocks, I am…