Over recent months we've been considering the fact that trading momentum - buying winners and selling losers - works extremely well. In fact, the returns from the strategy are much higher than those from value or growth strategies, albeit at the cost of greater volatility. We've seen that momentum strategies can 'crash', as was witnessed in 2002/3 and 2009, and many hedge funds as a result have given up on it as a trading strategy.

However a groundbreaking research paper by David Blitz, Joop Huij and Martin Martens published in the Journal of Empirical Finance in January 2011 introduced a novel way of investing in momentum that appears to hold some hope for those investors that can't help but chase winning stocks. In it they promoted the idea that stripping the market's influence out of each stock's measured return can seriously improve the profits from a momentum strategy.

To illustrate these ideas, it may help if one thinks of the stock market as a sea of fish. Historically these fish have all been very independent minded and while they've always been affected by ocean currents, they have swum very independently. But since the turn of the millennium the fish have begun to behave more and more like a shoal, more and more like synchronised swimmers, ebbing and flowing in unison.

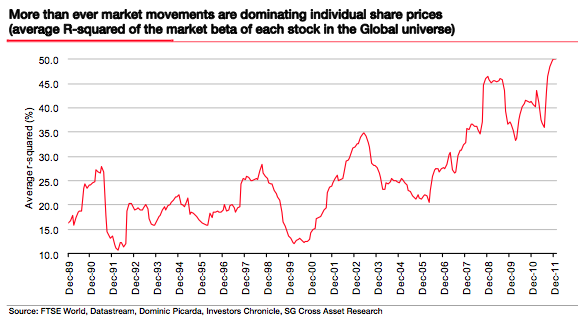

Before 2000, the average stock's daily move was perhaps 20% correlated with the overall market, but this correlation has risen year after year to reach 50% by the beginning of the year (see image below). Given the growing influence of ETF and index funds and the dominance of macro-politics on market swings, this is perhaps unsurprising, but it's making it a much harder market for traditional stock pickers to outperform in.

Andrew Lapthorne, global head of quant research at Societe Generale, states that when "macro and market events and not company fundamentals drive stock prices then using momentum as a trading signal becomes fraught with danger".

The solution, as described by Blitz, Huji and Martens, is to focus on the momentum of the stock not explained by the impact of the overall stock market. By stripping out the market sensitivity from each stock's share price returns they can then be ranked by what they call the stock's "residual momentum".

Soc Gen, when testing this strategy, confirm that globally annualised returns are on…