Last week, I wrote about how I use the StockReport to quickly assess a possible investment opportunity. Being able to filter out stocks that don't look interesting or don't match my investing style means that I can focus my time and energy on investigating the ones that do. The StockRanks can be an important part of this initial look, even if they simply point me to where I should be looking. However, I don't think the StockRanks are perfect. No investing tool allows invetsors to beat the market all the time. If it did, everyone would use it, and it would stop working. There are a few fallacies that those unfamiliar with how the StockRanks work tend to fall for. This week, my aim is to dispel these myths and, in doing so, enable investors to use the StockRanks to give them a behavioural edge and overcome the biases that typically plague investment decisions.

Fallacy #1 – Every SuperStock will be a winner

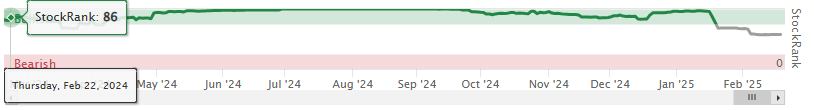

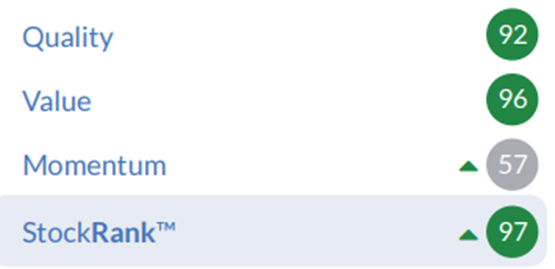

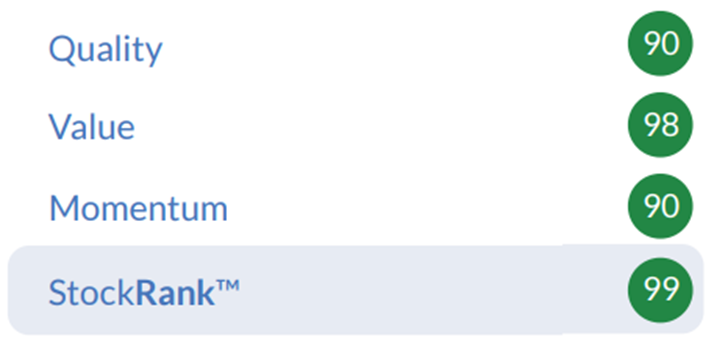

The most common criticism levelled at the StockRank methodology occurs when a highly ranked stock takes a bath. Investors wonder how could something that the algorithms love perform so poorly. For example, prior to the recent warning, this was the StockRanks for IG Design (LON:IGR) :

Here are the StockRanks when the shares were over £2 in mid-2024:

The reality is that highly ranked stocks are often preferred by the algorithms because of the strength of their broker forecasts. If these prove to be incorrect, as they have done for IG Design (LON:IGR) , then this throws off the numbers. However, so much of investing is forward-looking, so it is better that the algorithms use these forecasts, on average, even though they are sometimes led astray.

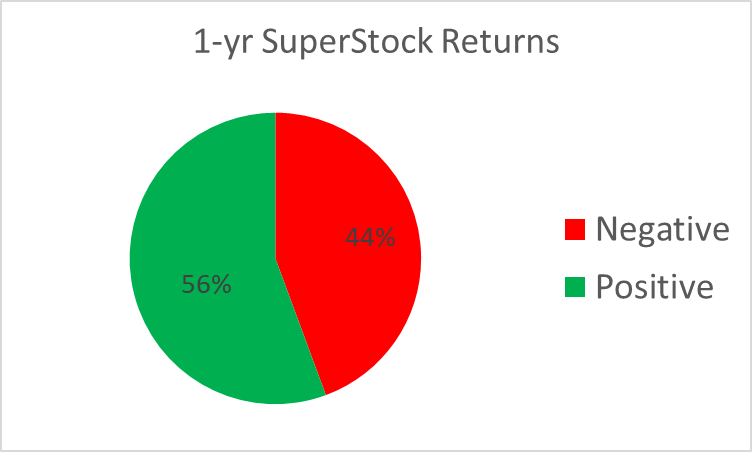

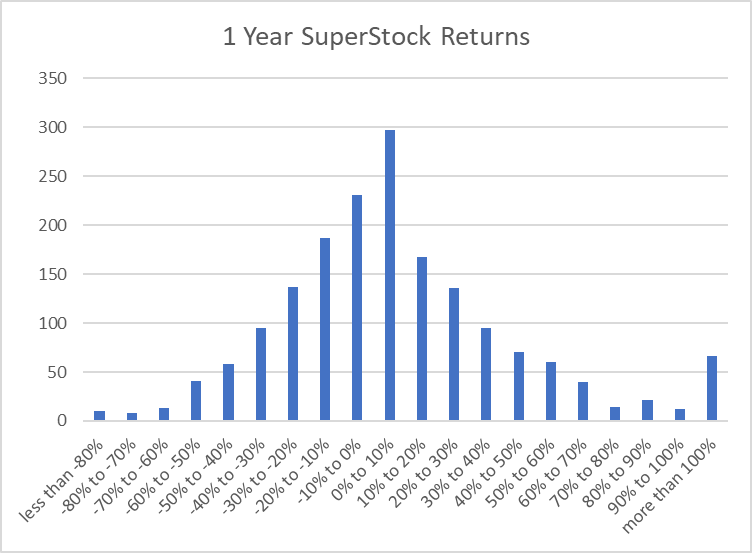

Even where profit warnings are not affecting the forecasts, the key phrase to remember is "on average". While the average performance of SuperStocks is very good, the range of outcomes is still wide. Indeed, here is the distribution of 1-year returns for 10 years worth of UK SuperStocks at the end of March:

From the same data, the chance of a UK SuperStock generating a positive return over the next year is 56%: