We all know the feeling. An otherwise smooth flight is interrupted by a couple of bumps. We hear a bing-bong, and the seat belt sign comes on. The cabin crew ask us to return to our seats. We are in for a rough ride.

It is the same for our high-flying investments. High-quality companies with strong momentum can be one of the fastest ways to reach our investing destinations. However, they also come with a significant risk of turbulence. Companies that are flying high have much further to fall when atmospheric conditions change. With turbulence on a plane, we are along for the ride, whatever comes our way. Not so with our investments, where we are mainly free to sell whenever we choose. Is it possible to get out at the right time?

Is there a bing-bong moment for high-flying investments?

There is a market saying that “nobody rings a bell at the top or the bottom of a market”. This is true. No investor consistently gets in at the bottom and out at the top. However, investors who get out when the seatbelt sign comes on following those first few bumps will do much better than those who need to reach for the sick bags.

Given the value of this potential insight, the team at Stockopedia have spent a significant amount of time trying to answer this question. A few weeks ago, I looked at the effect of investors avoiding the lowest-ranked stocks on their least preferred measure. The answer was pretty clear for Contrarian investors who like cheap, high-quality stocks. They should fight their urge to go completely against the crowd and would do better (at least in our simulations) by avoiding stocks with terrible momentum characteristics.

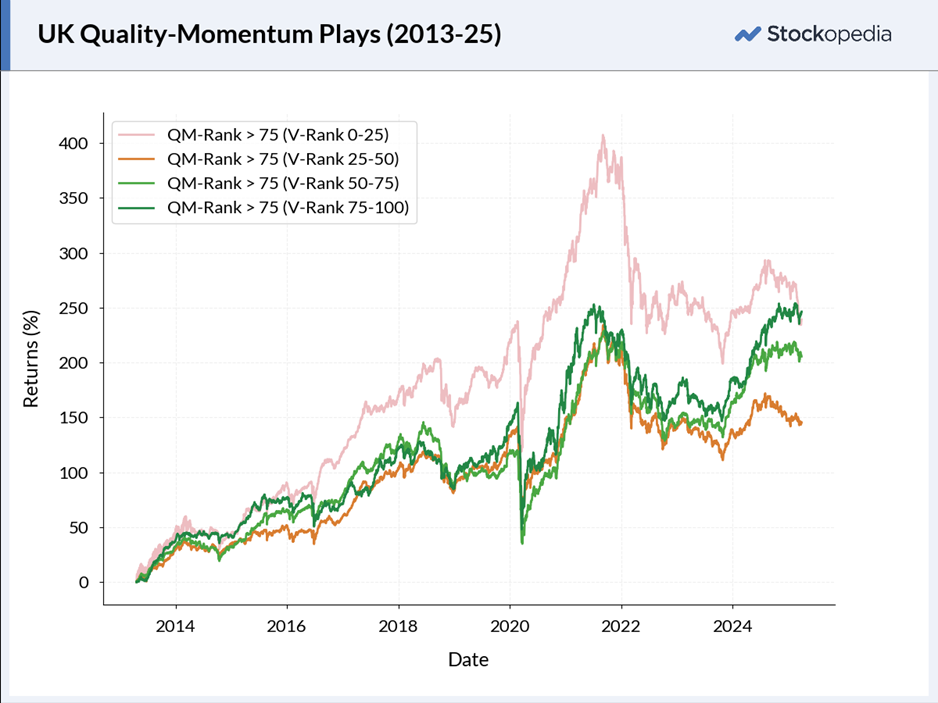

However, the case for investors in High Flyers avoiding the lowest Value-ranked stocks is not as clear-cut. There are times when this would have worked (most notably during the recent weak UK markets). However, overall, there was no clear advantage to this, as the following chart, which splits high QM stocks into V-quartiles, shows:

Last week, Roland asked if falling Momentum could be a warning sign of trouble ahead. He gave interesting examples of Bunzl (LON:BNZL) and Celebrus Technologies (LON:CLBS) , where the drop in Momentum Rank signalled concern before some big falls in the share…