Hi everyone, hope you are all safe and well?

I've a main stocks and shares ISA which I've been running since 2006 and I have detailed transaction and contribution records on spreadsheet from the start. I have the date and value of every cash deposit I've made into my ISA. Unfortunately/regrettably I never unitised my portfolio until this year. Hopefully I will keep the discipline to unitise going forward which should make things easier.

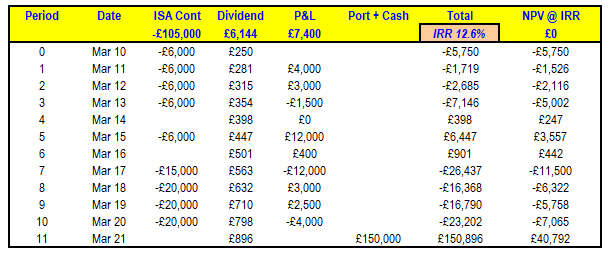

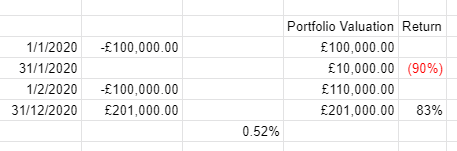

I was however trying to figure out how to calculate the performance of this ISA to calculate a CAGR (cumulative average growth rate) so I could understand my performance. From research online I've seen the XIRR calculation feature being suggested. I tried this in my Libre Office spreadsheet however this came out at a rather baffling clearly wrong % of just over 2%. I know this is wrong because had I invested all my capital on day 1 back in 2006 the CAGR would be 6.7% (per a quick calc here https://www.vertex42.com/Calculators/cagr-calculator.html). Of course my capital was deployed over many years and lumpy in contributions. I also know that between 2016 and 2019 the value of my portfolio doubled and only a small portion of this value change was due to contributions. Further in 2020 (without any contributions in the calendar year) my performance was just over 8%.

I'd appreciate if anyone can share their thoughts/experience on how to calculate CAGR with just the dates and amounts of contributions over 14 years and the value of the portfolio as of today or any specific month end?

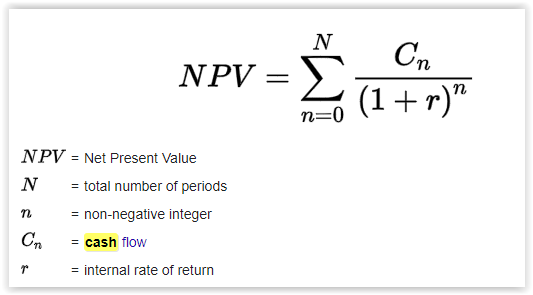

This CARG calculator shows "the workings". That is to say, it shows the mathematics in action: