Seeing the conversations that have been stimulated by our recent stock research pieces, I thought it might be helpful to make this post as a forum to discuss promising companies that display moat-like characteristics. The scope can be international. Any comments or research ideas are welcomed.

At the moment, I have a list of candidates that is a hybrid of my own picks, subscriber suggestions and companies that qualify for various screens.

Below you'll find a quick refresher on economic moats followed by a compilation of recent notable activity in the moat candidates I've found so far.

Moat economics

Warren Buffett once said: ‘put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.’ It sounds simple. The challenge lies in identifying and sticking with these companies.

This is partly because highly profitable firms attract competition. Capital is drawn to the areas of the economy that have the highest expected returns. These competitors often undercut the incumbent on price. As a result of this pattern, most highly profitable companies become less profitable over time.

When you dig down to the individual company level, however, you can find candidates that buck this trend by consistently posting profitability figures above the norm. The chances are, these companies have economic moats that guard their margins.

Pat Dorsey, originally of Morningstar, has done a lot of work into mapping out this simple but powerful idea. In The Five Rules for Successful Stock Investing, he identifies five types of sustainable competitive advantage:

- Real product differentiation through superior technology or features

- Perceived product differentiation through a trusted brand or reputation

- Being the low-cost producer

- Locking in customers with high switching costs

- Locking out competitors with high barriers to entry or high barriers to success

Identifying companies with potential moats involves a lot more qualitative research than other investing styles. At some point, you have to ask both why a company earns such high returns and how long this dynamic might continue. A lot of reading company reports, thinking about strategy and industry, and reading between the lines can go into answering these questions.

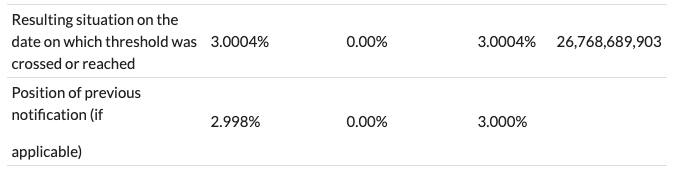

Last week saw a flurry of activity in the set of companies I have so far identified. There were buybacks, director deals, major shareholder moves and more. I’ve listed some of the more notable announcements below.

Are these signals to conduct further research, or…

.jpg)