The UK’s FTSE 250 index has delivered solid returns in the years since the financial crisis. But if you believe commentators in the financial press, the current outlook for mid-caps is pretty gloomy. In particular there’s a sense that the outcome of Brexit could hurt what many perceive to be an index that’s a ‘bellwether’ of the UK economy.

Yet on closer inspection the FTSE 250 is home to stocks that could be much more resilient than some assume. For a start, it has a much broader exposure to foreign earnings than it often gets credit for. Plus, while its companies are obviously much larger than those in the FTSE SmallCap and AIM indices, many have got more than enough growth in them to deliver the kind of strong price gains usually associated with much smaller shares.

So for investors considering their options as the tax year draws to a close (and a new one begins), the FTSE 250 could be worth a look. This week I went looking for some of the highest quality, strongest momentum names using Stockopedia’s framework for finding what we like to call High Flyers.

Exploring UK mid-caps

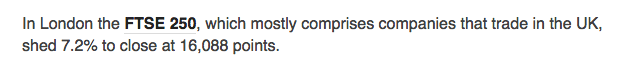

Last year the FTSE 250 racked up a return of 14.6 percent, which was twice that of the FTSE 100. Since the market slump shortly after the EU referendum in June 2016, it’s gained around 32.2 percent. But while those returns have been propelled by the prevailing economic climate (QE, low rates, etc), there’s been a nagging grey cloud hanging over mid-caps ever since the UK voted to leave the EU.

Part of the reason for that was seen soon after the referendum result. Britain’t blue-chip FTSE 100 index responded fairly well. That’s because the tumbling value of sterling supercharged earnings in an index where 70 percent (and more) are generated in foreign territories. It was a forex windfall.

But the impact of the vote - and the currency effects - were nowhere near as clear for the FTSE 250. Here are a couple of press quotes from the day after the referendum...

Source: BBC

Source: FT

This kind of commentary (and there’s a fair amount of it) implies that British mid-caps are generally domestically-oriented. But that’s not quite the case. In fact FTSE 250 companies earn around…