Metals and Mining shares were some of the big winners in 2016. Various factors conspired to push their prices higher, which wrong-footed a lot of investors. But one of the interesting things about this surprising bull run was that it came just as a number of miners were actually cutting their dividends. Those two factors don’t normally go hand in hand.

But with the worst of those cuts perhaps over, there are signs that dividend growth is back on the agenda. In fact we’ve seen a spate of companies easily beating their dividend forecasts.

Mining booms and busts

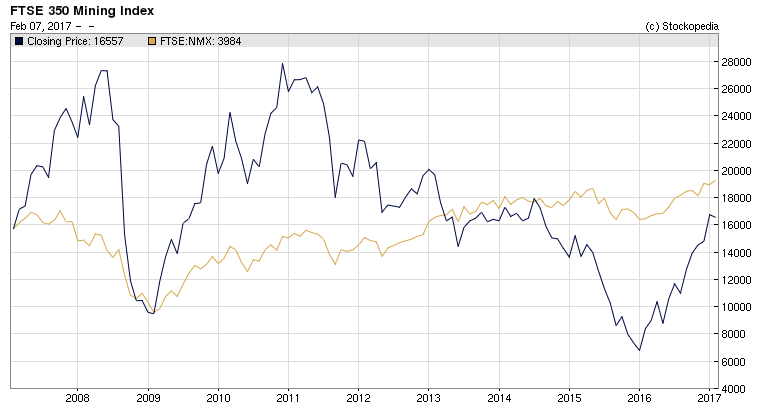

Mining stocks have been on a roller coaster run since the turn of the century. Initially, it was strong demand from emerging markets like China that was the catalyst for strong gains. Even a sharp pullback in the financial crisis proved short lived. But the momentum ran out by around 2011 and didn’t return until 2016.

This chart shows how the FTSE 350 Mining Index has swung wildly against the FTSE 350 over the past 10 years.

From the get-go last year, rising commodity prices signalled a change in fortune. It came at a time when miners were in much better shape after several years of cost-cutting, asset sales and sweating production more efficiently. For UK-quoted stocks, the devaluation of sterling last year also made their dollar-denominated earnings and dividends more appealing.

Opinions are divided on how far this rally will go. Neil Woodford, whose Woodford Equity Income Fund lagged the FTSE All Share last year, is sceptical. His annual review suggested that the recovery in mining and oil & gas sectors has gone “way beyond what the fundamentals would justify”. But others disagree, with analysts at Goldman Sachs and Citi, for instance, predicting a strong run from some commodities in 2017 as oversupply issues fade away.

Mining the market for dividends

One interesting feature of the mining gains in 2016 was that dividends from the Basic Materials sector halved year-on-year to £3.3bn. Figures that low haven’t been seen since around 2010. According to Capita Asset Services, which tracks UK dividends, payouts from the Mining industry group fell by 64% to £2.4bn.

But for the time being, those sharp reductions seem to be the last wave of cost-cutting. In fact, some mining companies are now expected to start hiking their payouts, and some already have. It…