Investing is about the future – future share prices, future earnings and future dividends – and that’s where the problems really begin because predicting the future is hard. Well actually it’s more than hard, it’s impossible (go ask a quantum physicist).

But don’t let that put you off, because it’s not like we live in a world of pure randomness. For example, if I say that the sun will come up tomorrow, I’m very, very likely to be right (even if I can’t see it because of all the clouds).

So we have a world in which some things are very likely to happen (the sun coming up tomorrow), some things are very likely to not happen (a giant squid destroying New York), and almost everything else fitting somewhere in between.

What does all this have to do with investing in defensive stocks?

Good question. The answer is that defensive stocks are consistent performers and:

In the stock market, risk, return and consistency are all closely related

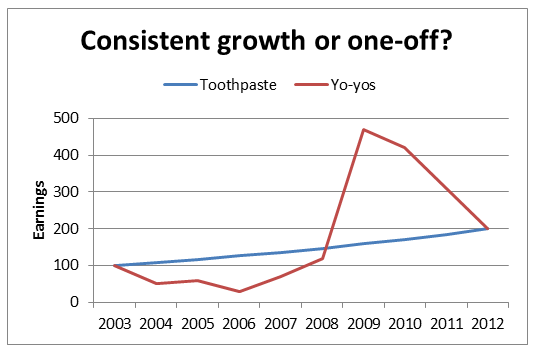

Let’s take a look at two hypothetical companies. The first one sells toothpaste, while the other sells bright red yo-yos.

Over the past 10 years, both companies have grown their revenues, earnings and dividends by 100%. At their current share prices, both companies have the same PE ratio and the same dividend yield. With just that information it’s hard to come to any conclusions as to the relative attractiveness of each investment.

Things become a bit more interesting when we look at the earnings for both companies in the chart below:

Of course this is a slightly artificial example, but there are plenty of companies out there that look like either one of those plots.

If you’re looking to invest in defensive stocks like the toothpaste company, you should be able to make some reasonable guesses about possible future earnings. The main assumptions would be that the world still needs toothpaste and that this company can continue to compete effectively. History would suggest that both those assumptions are reasonable, although of course some additional investigation would be required.

The story for the yo-yo company is entirely different, and it goes like this: In 2006, some trendy kids started buying red yo-yos and started a new, underground trend. By 2009 it had hit the mainstream with celebrities and eight year old girls jumping on the…