It might be a bit soon to say the market is properly recovering from last year’s sharp slide, but some stocks have rebounded strongly in 2019. And for others, the correction last year hardly dented their price momentum at all.

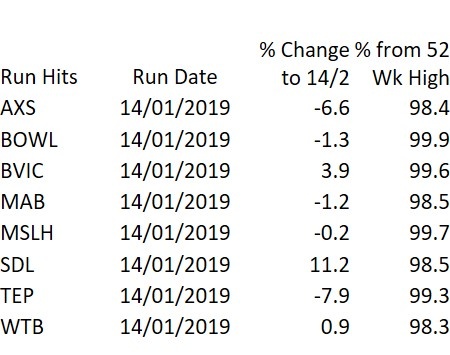

In these kinds of choppy conditions, one screening strategy that offers an interesting perspective on the market is the 52 Week Highs list. After a spell of downward pressure, it acts like gauge of shares that are bouncing back fastest.

Most investors take a passing interest in the stocks that are hitting new highs. It’s the kind of data that can be found in newspapers and on financial websites everywhere. But what makes the 52 week high such an interesting datapoint is the psychology behind it. A couple of decades of academic research has shown that ‘new highs’ can provoke all sorts of irrational behaviour in investors...

So whether you’re interested in price momentum and new highs or not, just knowing about this irrational behaviour might give you a more objective view about how the market reacts to 52 week highs - and how to profit from them.

What lies behind the 52-week high?

On its own, the 52 week high is a pretty static number. Yet research shows that stocks hitting new highs often drift higher in price over the following weeks and months.

This upward trend is called “post earnings announcement drift”. It’s an academic name for when investors only slowly buy shares that are already trading around new highs. When earnings news about these kinds of share is published, particularly if it’s a positive earnings surprises, prices can be slow to react (as market efficiency momentarily goes out the window).

This confused reaction is caused by what the psychologists Amos Tversky and Daniel Kahneman called anchoring-and-adjustment. The idea is that humans form an anchor, or a belief, using a reference point (like a share price). As new information comes to light (like new earnings news) they only adjust their beliefs slowly, before going on to buy the shares at even higher highs.

In investing, the idea of anchoring around events like 52 week highs and earnings surprises is thought to be a big contributor to the ‘momentum effect’.

In fact, work by academics Thomas George and Chuan-Yang Hwang found that the 52 week high causes irrational pricing behaviour because of anchoring. As that behavioural…