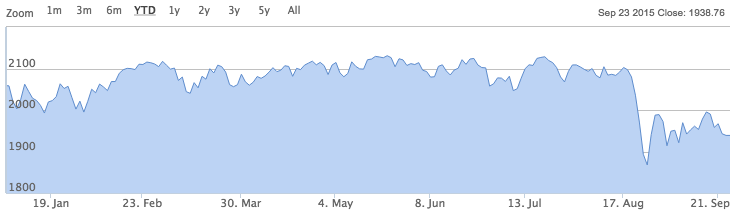

With the value of the S&P 500 down by around 7.8% since early August, this year is proving to be slow going for some of America’s largest stocks. But while equity prices have been under pressure in some parts of the market, one silver lining is that dividend yields on those shares have edged higher as a result. For income investors looking to diversify internationally, the recent pull-back in prices could offer the chance to pick up some of America’s most consistent dividend payers at improved valuations.

In recent weeks we’ve looked at ways of building a dividend strategy that combines yield, dividend safety and factors that target better quality businesses. That’s been based on some interesting (albeit limited) backtesting of what worked in dividend investing over the past year. As part of that we examined dividend growth here and looked how a myopic focus on yield, rather than the quality, value and momentum of a stock, might actually damage total returns here.

Dividend stocks at lower prices

In the United States, stock prices have enjoyed a multi-year bull run in the aftermath of the financial crisis. So it would be hard to argue that a sluggish 2015, with a pull back in August, has done much to unwind some racy valuations in places. But screening the US market for reasonable yields on shares in apparently strong, blue chip businesses, turns up a number of firms have suffered from fairly weak momentum in the recent past.

Searching for high yields in lower priced stocks is an approach that captures the spirit of Michael O’Higgins’ popular yield strategy known as Dogs of the Dow. His strategy works by simply buying the highest yielding shares in a blue chip index like the Dow Jones Industrial Index - or the S&P 500 or FTSE 100.

Part of the thinking behind the Dogs of the Dow approach is that high yield is a proxy for relative cheapness. As a share price falls, its yield rises, all other factors being equal. So the strategy targets firms that might be near the bottom of the business cycle and have seen their share prices fall as a result. Given that these stocks are generally well financed businesses with a well established, robust dividend history, the strategy bets that the dividends will remain intact. And when the business cycle improves, the share…