Warren Buffett once said that “Investing is simple, but it’s not easy”. I guess he finds it hard, like me, because he binge-watches Netflix instead of doing investment research. Yes, it’s damn hard to be a good investor these days. So many important things to do, like streaming season 42 of “yet-another-tv-show”, scrolling 300 feet of social media or downloading yet another to-do app to see if it makes you more productive.

But seriously, we do live in an information-overloaded age. Do you know what the brain does to cope with all this information? It classifies, and groups everything as a shortcut. We develop buckets for everything - from people to animals, to brands to stocks. It makes coping with the world so much easier, even if we argue (and often fight) about where the edges lie.

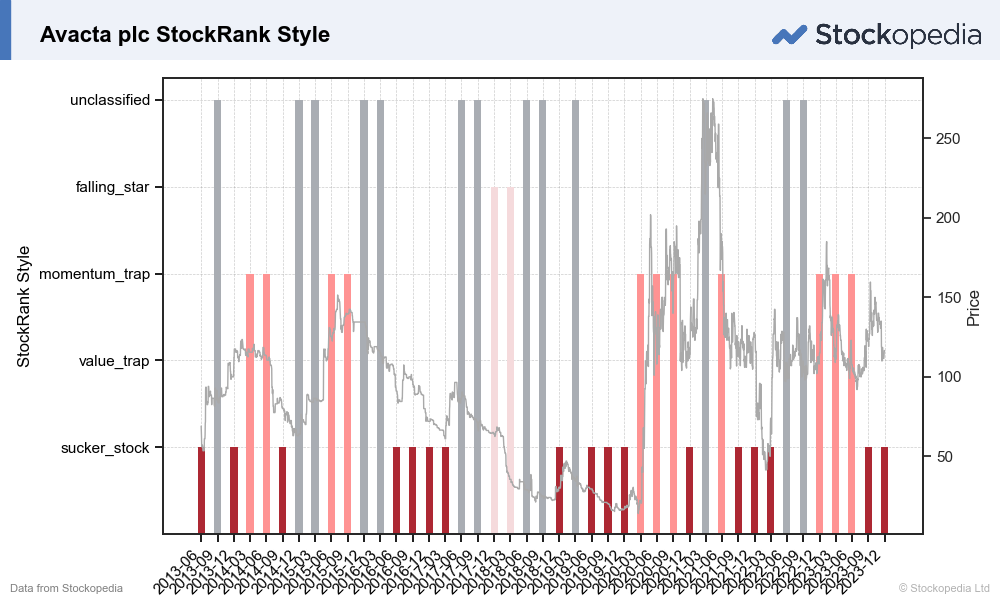

The problem in the stock market is that the groups we instinctively use can be extremely narrative driven . We think “it’s an innovative stock”, rather than empirically knowing “it’s a low odds stock”. Following narratives with your money can, like following a pied piper, lead you teetering from a cliff.

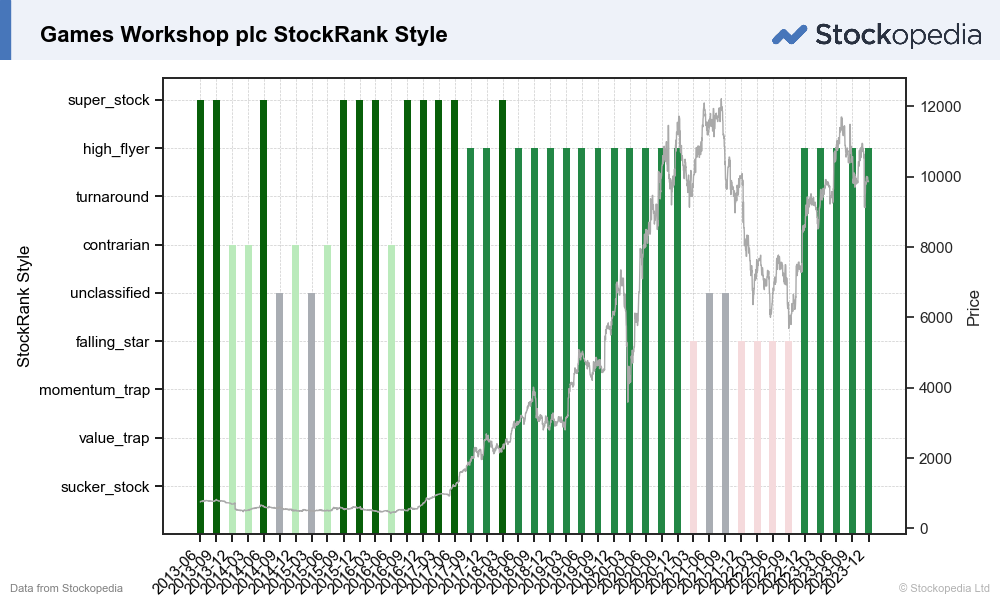

So it’s on that note that I’d like to give some background to the data-derived classification system we publish. They are called “the StockRank Styles” and they still enthuse me just as much as when we invented them. They really do help separate the real winners from the losers in the stock market. So let’s dive in

A map for the stock market - from super to sucker

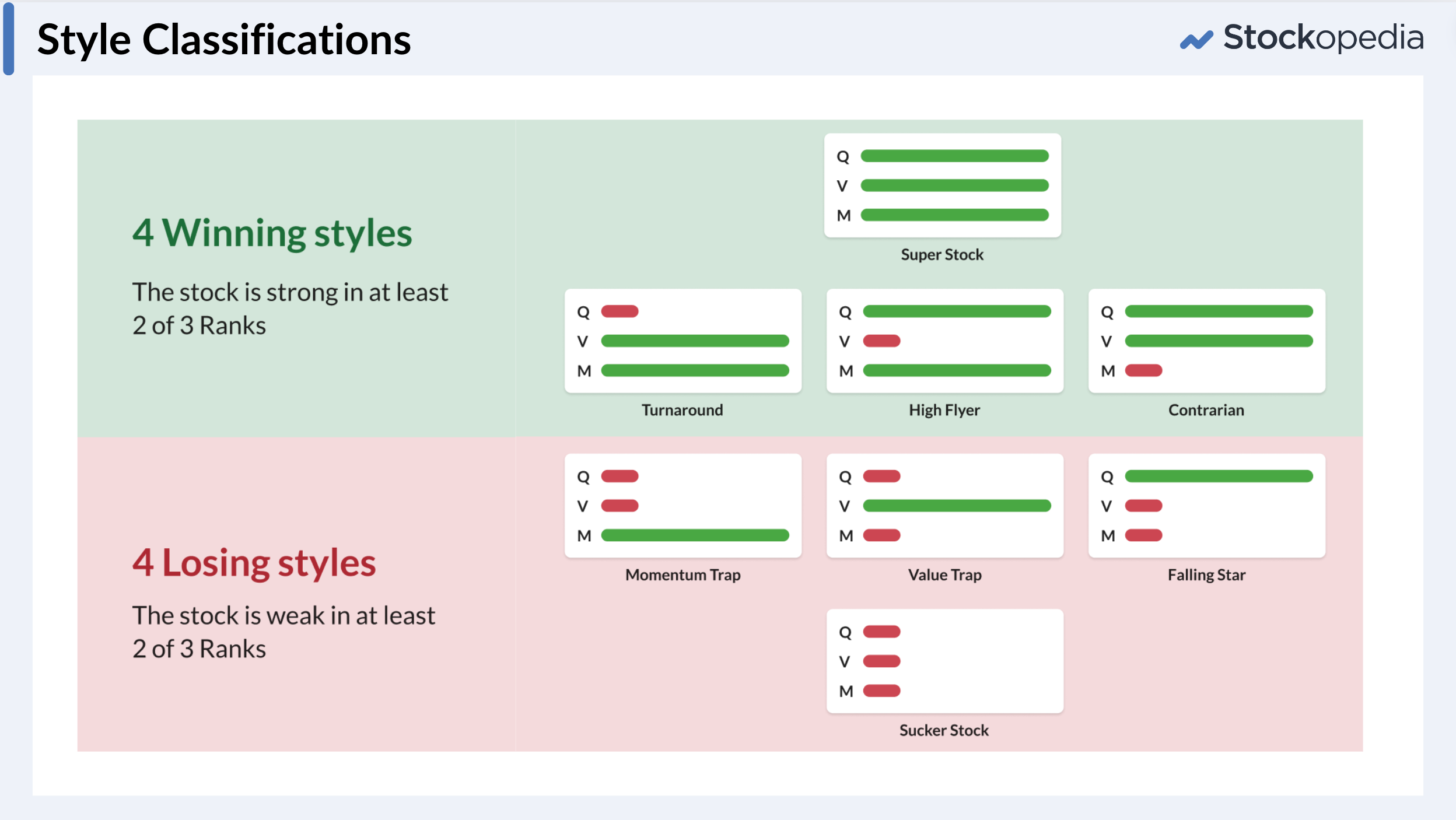

We classify every stock we cover across one of eight different styles. Each style depends on its relative ranking for Quality, Value, and Momentum. If we simplify these 0-100 rankings, many stocks can be considered either strongly or weakly ranked for each of these measures. Combining all the possible variations of these strong/weak, quality/value/momentum pairings gives us eight unique combinations. They can be seen in the diagram below.

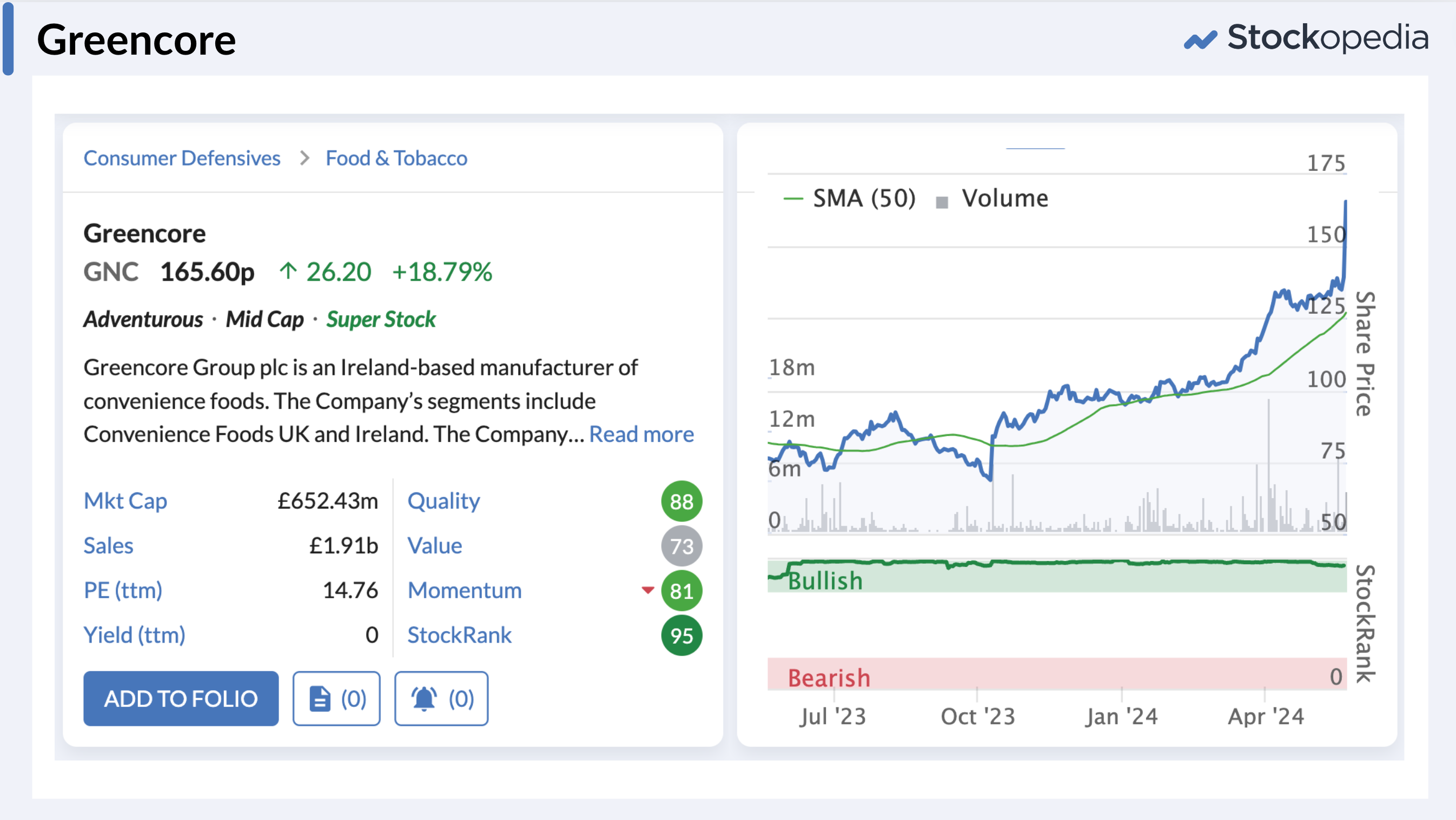

So, for example, let’s look at Greencore. This stock shot up on Tuesday by 18% after an ahead of expectations announcement, (read Graham’s views on the announcement here). Its high Quality, Value and Momentum Ranks lead it to being classified as a “Super Stock” in the Styles schema.

It isn’t unusual to find “Super Stocks” like Greencore announcing earnings surprises…