Of all the metrics used by investors to understand the trajectory a company might be on, growth in both sales and earnings-per-share are among the most important.

These measures are a natural starting point when it comes to studying company growth. But they’re also useful in other areas, such as stock valuation. For that reason, you find them in strategies across a whole spectrum of investing styles, including value, momentum, yield and growth.

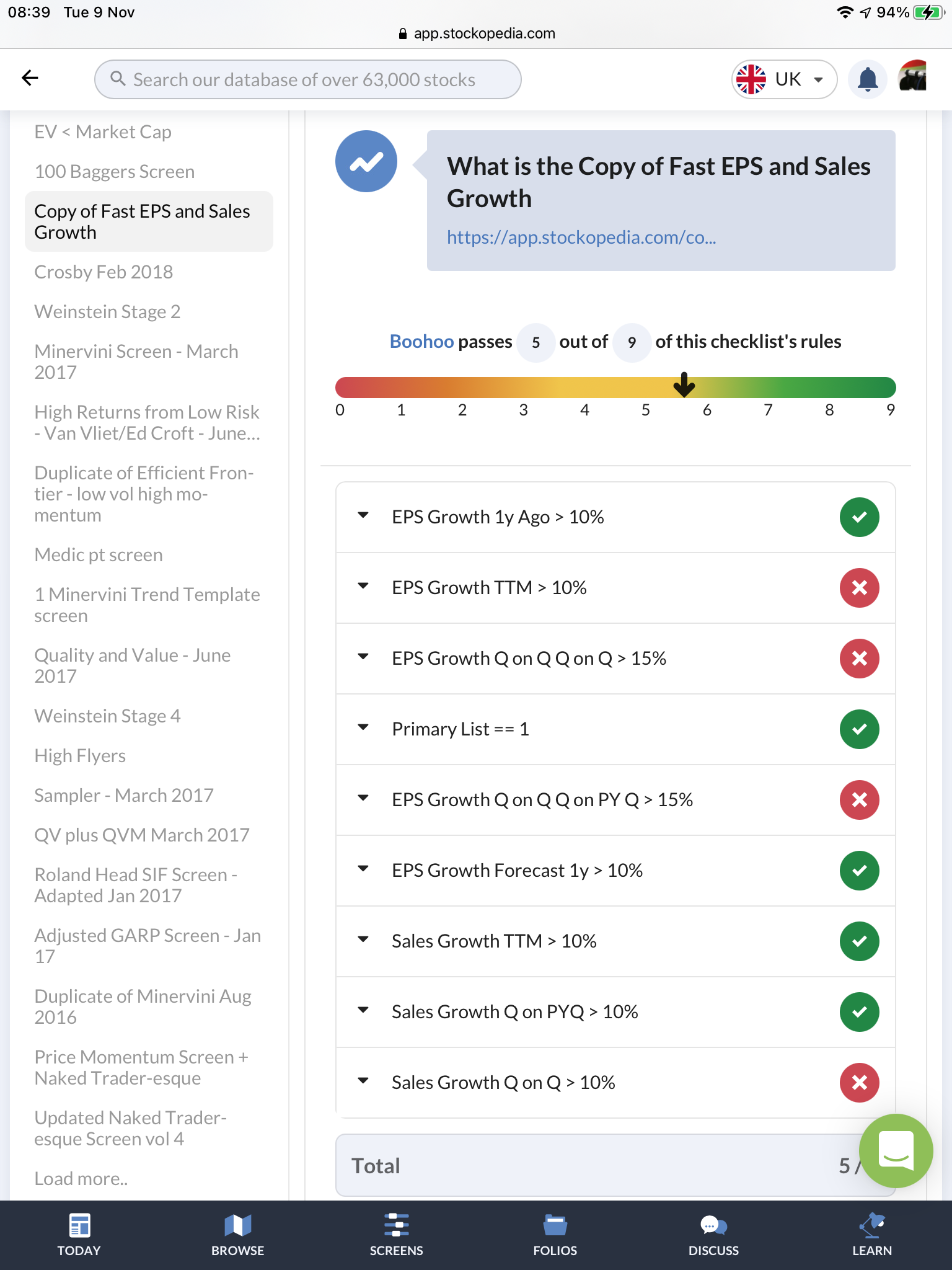

While most of us take an interest in company income, it’s growth investors that really prioritise positive changes in sales and earnings. That’s because comparing growth over different timeframes (including what might be expected in the future) can help track down some of the most exciting and fastest growing companies in the market.

In this article we’re going to look at why sales and earnings are important and how you can use them to find fast growing companies.

Understanding what sales and earnings really are

On a company income statement, sales are the top line and earnings are the bottom line. Most of what sits in between are expenses, taxes and accounting adjustments.

Sales is a term that’s interchangeable with revenue and turnover - and without it there can usually be no earnings.

Part of the reason why sales are taken seriously in growth strategies is that it’s a measure that is hard to manipulate. All things being equal (and legal), sales figures are metrics that management can’t easily dress up. So any investor looking for strong and accelerating earnings over time will want to see that sales are growing too.

In some cases - where a company is yet to generate earnings - sales might be the only obvious clue to growth. In the dotcom boom in the late 1990s, the price-to-sales ratio became a popular way of valuing companies with no earnings (and in many cases no chance of generating any). Understandably, the P/S ratio fell out of favour after that, but today sales and the P/S ratio are still very important measures.

Ultimately, however, most investors want to see sales lead to a positive bottom line - and that means positive earnings. Earnings is essentially a byword for profits. It captures what the company makes in sales minus all the associated costs that come later on. What’s left is attributable to common shareholders, and companies will retain or reinvest…