I like simple rules. But I especially like a quantifiable edge. The StockRanks give me that, and I’ve happily invested with them for a decade. When you know your odds, it makes decision making easy. If I buy ten 90+ ranked shares, six have on average been winners, and the winners gain more than the losers lose. It varies year to year, but the impact compounds wonderfully through time.

But I know private investors, and I know myself. 10% per year isn’t enough. We want more. We want 20%. We want 50%. We want multibaggers. But herein lies a problem. In reaching for returns, we step into more speculative territory. We get drawn into late-stage narratives. We start to lose our edge.

Now I’ve learnt through a lot of pain, that narrative-based investing isn’t good for me. But statistics, I know I can back. And occasionally, you can find a statistical edge in unlikely data sources. If you can match an edge with a story - that’s where the really good returns lie.

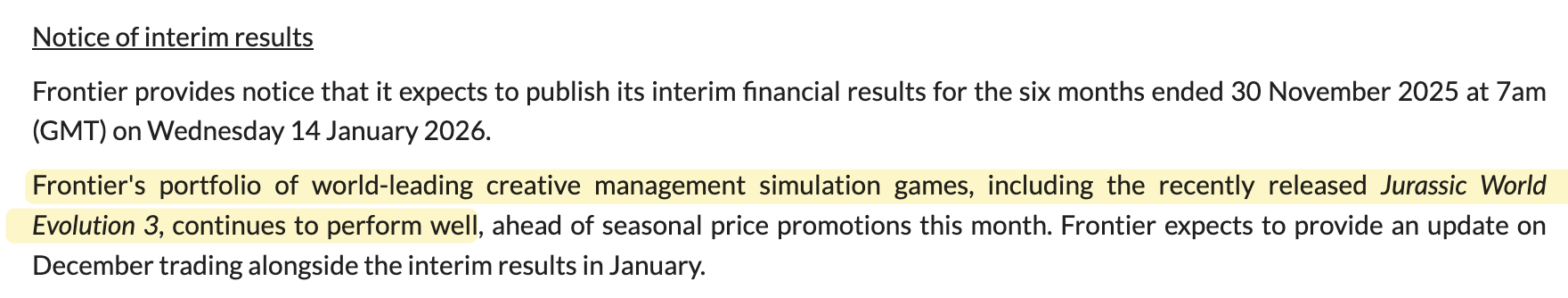

This year, I’ve found overlooked anomalies in a pair of UK gaming stocks - Trufin and Frontier Developments. While the early, easy gains may already be made, I want to share the process I’ve used to gain a small edge, as readers may be able to learn from it.

A conversation with Mark Simpson reminded me of his excellent piece, Sleuthing Your Way to an Informational Edge. He makes the case for using Google Trends as a research tool. This has now become one of my favourite sources of “weird data alpha” - particularly in small caps. What follows is how these sources have helped build conviction in two discretionary positions this year.

Case 1: Balatro drives Trufin gains

Flying back from Australia at Christmas, I noticed my eldest son, now 21, wasn’t watching movies. He was glued to a game on his iPhone. He introduced me to Balatro. While killing time in Dubai airport, I downloaded it… and promptly played for eight straight hours until my eyes nearly bled. It’s hard to describe - a mashup of poker, deck-building games and trippy psychedelia. Try it, and you’ll be hooked.

A few weeks later, I was analysing how “significantly ahead of expectations” trading statements drive future returns. Among January’s positive announcements, one name…