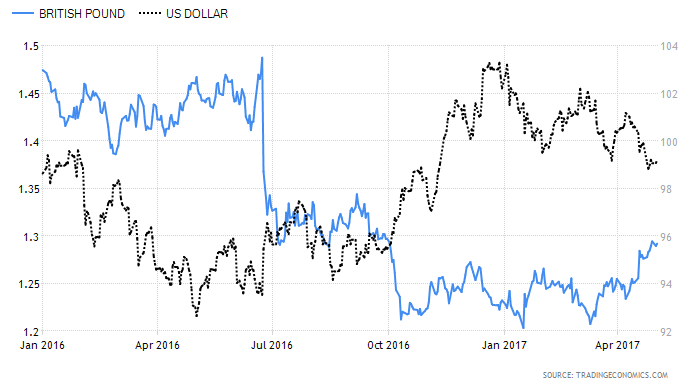

FTSE 350 dividend growth hit double figures in the first three months of 2017. Most of the rise was driven by the weaker pound, which has boosted payouts declared in foreign currencies. But there are signs that this exchange rate sugar rush could soon wear off.

Without a pickup in profits growth - which is usually the main driver of dividend increases - a slowdown in dividend growth could be on the cards by as soon as the third quarter. So in the hunt for income stocks it’s more important than ever to pay attention to whether eye-catching dividends are sustainable.

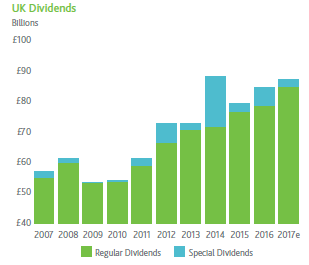

The latest dividend figures from Capita Asset Services show that UK payouts rose to £15.4bn in the first quarter. That was up by 9.5% on the same period in 2016. Stripping out the impact of special dividends, which fell to a six year low, dividend growth came in at a record 16.2%.

Source: Capita Asset Services

To understand how exchange rates affect dividends, it’s worth exploring where the payouts come from. During the average year, a little over two-fifths of overall UK dividends are declared in foreign currencies. But in Q1, the weighting actually rises to three-fifths of the total payout. Given the devaluation of sterling since last year’s EU referendum, these sorts of currency effects come into sharp focus.

As a result, the impact of the lower pound added £1.7bn to the total payout in Q1 - or 12 percentage points on the headline growth rate. Most of the rest was down to a whacking rise in the dividend payout from the mining giant, BHP Billiton. Without these two factors, underlying dividends would have actually fallen year-on-year.

In terms of sector performance, the best dividend growth was seen in oil, gas and energy, resources and commodities, consumer goods & housebuilding, and telecoms. But growth fell in retail & consumer services and healthcare & pharmaceuticals.

In the FTSE 100 - where around 70% of revenues come from overseas - dividend payouts increased by 16.8%. But nine-tenths of that was attributable to weaker sterling, suggesting that underlying growth was quite weak.

By contrast, in the FTSE 250 - where some 50% of revenues come from overseas - nine-tenths of payouts are declared in sterling. So according to Capita, the impact of exchange…