What should be the investors' mantra in 2015? I would vote for: “Income, income, income", given the paltry interest rates on offer from bank and building society savings accounts. You can forget UK gilts (government bonds) as a source of income too, as a 10-year gilt only offers a pre-tax yield of 1.3% per year!

Within UK stocks, one of the most attractive homes for cash in your ISA (don't leave any ISA top-ups to the last minute in April!) and any recently-liberated private pension savings is in UK house builders such as Barratt Developments (LON:BDEV), Berkeley Group (LON:BKG) and Taylor Wimpey (LON:TW.)

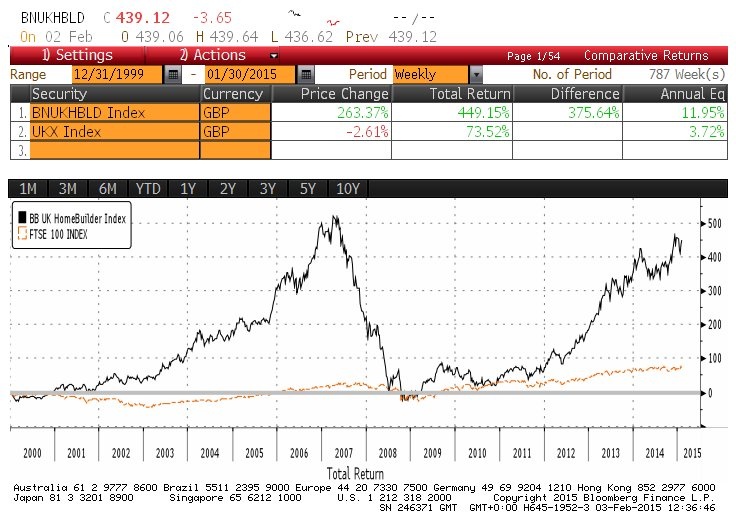

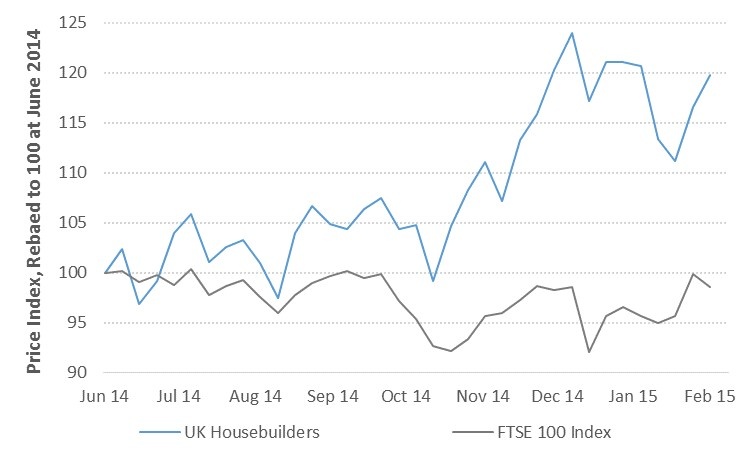

As a group, house builders such as these have enjoyed strong performance in share prices, gaining 20% since June of last year while the FTSE 100 index has struggled to remain flat (Figure 1).

1. House Builders Leave the FTSE 100 in the Dust

Source: Stockopedia.com

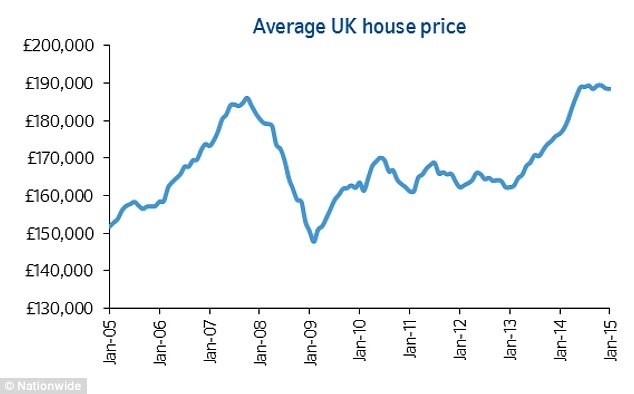

Yes House Price Inflation Is Slowing, But Prices Are Still Rising

Unless you have been living on Mars these past few months, you will most likely be aware that UK house price inflation is slowing, with the Nationwide Building Society reporting a monthly gain in average prices of only 0.3% in January 2015, resulting in a yearly gain of 6.8% and driving the average price of a UK property up to a new all-time high of £188,446 (Figure 2).

2. House Prices Up 6.8% Over the Last 12 Months to £188,446 Average

Source: Nationwide Building Society

There are a number of economic factors that should support house prices over the year ahead, perhaps allowing for modest further house price inflation over 2015:

- Lower unemployment (latest rate down to 6%) and improving wage growth (+1.6% year-on-year);

- Lower energy costs on the back of lower petrol prices and lower utilities bills, boosting household discretionary income;

- Lower average mortgage interest rates as banks and building societies become more aggressive in chasing new mortgage and re-mortgaging business, with a 2-year fixed rate for a 75% loan-to-value (LTV) mortgages heading down toward a new low of 2% (Figure 3),

3. UK…