There is a saying sometimes attributed to Winston Churchill, ‘never waste a good crisis’.

Recent lockdowns have caused companies with creaking business models to take some hard looks in the mirror and to really focus on what they must do if they are to prosper in the years and decades ahead.

Towards the front of that pack are a few established Retail players now looking to rapidly evolve. The way consumers act in certain ways has changed beyond recognition and some of these behaviours might be here to stay.

Below I’ve taken a look at two former High Street stars whose share prices have come undone. Both Marks And Spencer (LON:MKS) and Ted Baker (LON:TED) are saddled with expensive lease estates but behind the scenes there is operational progress like never before.

Both talk with a renewed sense of strategic focus, but is it too little too late?

Marks & Spencer (LON:MKS)

Revenue: £10.18bn

Market cap: £1.8bn

QV Rank: 84

What went wrong?

For many decades, Marks And Spencer (LON:MKS) was a shining star in the UK retail scene and to this day it generates copious amounts of free cash flow for holders. But its core big box retail operations are one of the most visible losers in the structural trend towards online shopping.

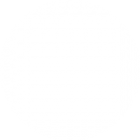

It’s a poor chart but there are signs that the share price has found a floor and perhaps it is over the worst of the share selling.

It is playing catch up online and has been soundly beaten by competitors such as Next, Boohoo, and Asos.

How has it been fixed?

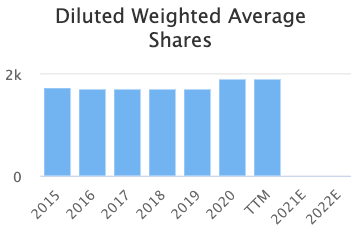

MKS remains profitable and significantly cash generative - so if this is as bad as it gets, it’s not actually that bad. This cash generation means that, even though sales are on a downward trend, there has been minimal shareholder dilution.

Debt levels have stepped up from £1.5bn in 2018 to £3.9bn in 2020 although the underlying picture here is obscured by IFRS 19 lease accounting changes. FY20 net debt excluding lease liabilities was £1.46bn, which is down slightly.

This year Marks announced its ‘Never the Same Again’ programme which will accelerate changes. In FY19 the group also made a ‘transformative’ investment in Ocado.

In recent years 54 legacy shared…

.jpg)