Some high quality companies are admirably run but they’re not going anywhere fast. Then you have outfits like Sigmaroc (LON:SRC) .

It lacks a consistent track record, its accounts are littered with adjustments, and its Quality score is non-existent - but dig deeper and you’ll find an experienced management team with a clear vision assembling a construction materials company of substantial scale.

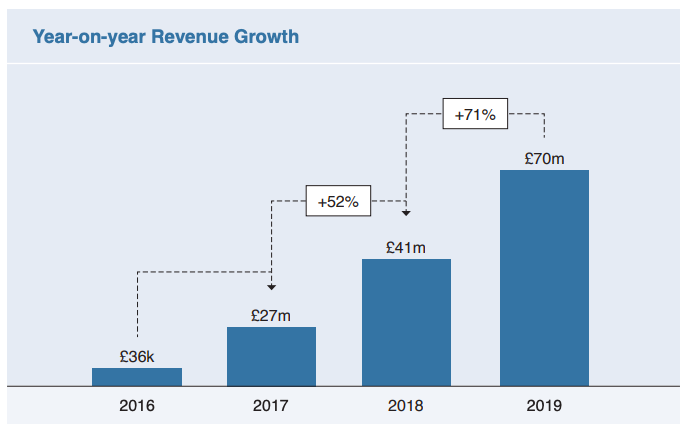

Five years ago SRC was a pitch, and then a cash shell. Today it is a £100m+ company expanding quickly into a c£500bn market, with a clear buy and build strategy and a strong pipeline of potential acquisitions.

It has some multi-billion pound large-cap incumbents in its crosshairs and there is a real sense of momentum here. The group is backed by solid institutional investors and has every chance of growing significantly in time.

I first looked at SRC here and saw enough to want to come back due to the sense of momentum about this company. The obvious red flag is a very poor Quality Rank but, if you believe in what this management team is doing, then what looks low-quality today might gloss over attractive underlying progress. Therein lies the risk and the reward.

Understanding Sigmaroc’s strategy and the competitive gap it has identified in the heavy construction materials market is key to grasping the opportunity here. It’s a market made up of concrete, asphalt blocks, cement, quarry aggregates, and related service companies.

The materials are cheap, heavy, and abundantly available. Importantly, transport cost is a key part of the overall price mix. This means proximity to market is an important driver of margin defence, so high-quality, well located assets have resilient margins. That’s point one.

Point two is that over the past 10 years there has been a period of consolidation in this sector, which is now reversing (per SRC management). Large businesses are not always good at running smaller, local operations.

This leads to a lack of ‘local-ness’. Think of the big network provider whose customer support function is on the other side of the world to its customers. This can develop into a fundamental weakness and allows nimble, smart, and ambitious new entrants to differentiate themselves on service.

That’s the opportunity for SRC. It can use this cycle of divestment to pick up attractive but mismanaged assets and improve them. These assets…

.jpg)