Attractive risk:return comes in many forms. Yes you have your safe, quality Unilevers but at the sharp end you have the dirt cheap ‘cigar butts’ that Benjamin Graham was so fond of.

It feels as though there are more than your average amount of interesting turnaround prospects at the minute. Perhaps it’s the COVID impact: bombed out share prices, emergency fundraises and transformed balance sheets, revitalised operational strategies…

We’re seeing Schumpeter’s Gale of creative destruction at speeds rarely witnessed, with many companies fitting years of evolution into a period of months.

There could be some once-in-a-generation opportunities out there (the same can be said about the risks, of course).

In Hemingway’s The Sun Also Rises, there is a snippet of dialogue that goes:

How did you go bankrupt?

Two ways. Gradually, then suddenly.

If you invert that you get something like:

How did you recover?

Two ways. Suddenly, then gradually.

Timing can be crucial. With turnarounds, the upside can be sudden and dramatic but sitting tight in the meantime requires a particular mindset.

With that caveat, I’ve started looking for turnarounds - but specifically those that are showing tangible signs of recovery and positive share price momentum.

Two such stocks on my radar are Tremor International (LON:TRMR) and Reach (LON:RCH) so I’ll look at them below - but it would be great to crowdsource some more candidates in the comments.

Tremor (LON:TRMR)

Revenue: £244.5m

Net debt (TTM): -£51.6m

Market cap: £292.8m

QV Rank: 73

Tremor was formerly Taptica, and before that, Blinkx.

It’s a digital video advertising specialist with operations in more than 60 countries.

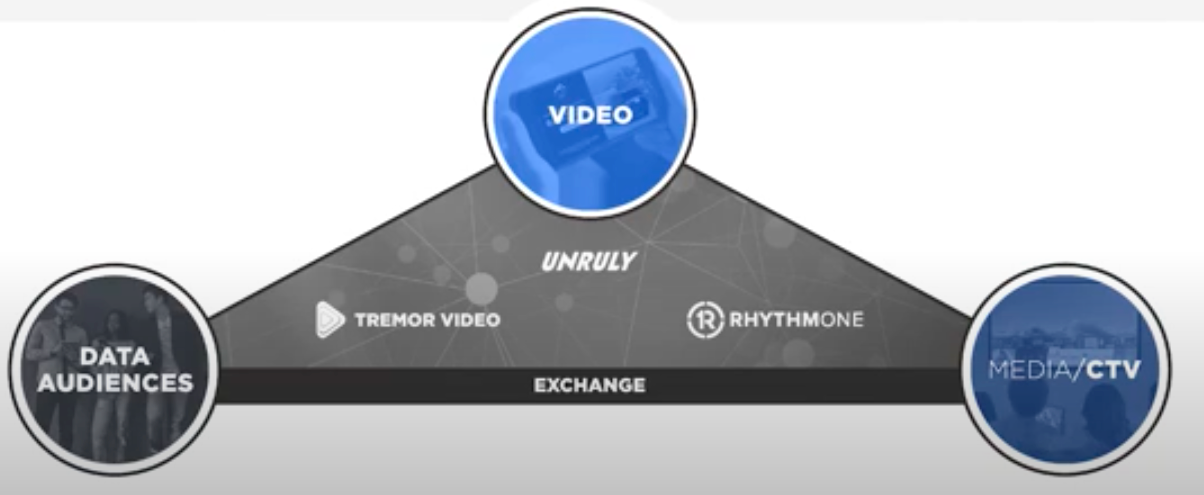

There are three core divisions: Tremor Video, which helps advertisers deliver brand stories through innovative video technology and audience data; RhythmOne, its media division; and Unruly, a video marketplace directly integrated with publishers and relationships with global advertisers.

The company deals in programmatic advertising and the bull case says recent acquisitions of RyhthmOne and Unruly have shored up Tremor’s technology stack, turning it into a truly end-to-end video advertising platform.

Breaking it down

And so what does that mean, then?

Economically, it’s almost like a stock exchange, but instead of buyers, sellers, and stocks, it matches brands, customers, and brand content.

It adds value in the middle by optimising those matches, collecting data on otherwise anonymous online users, providing…

.jpg)