Mid and large caps can generate solid gains and reliable income but if you want compounding, life-changing investments it helps to move further down the food chain.

Here are the best opportunities: high quality, profitable, small businesses with ambition and the runway to grow at 20%+ per year for many years. That’s where the next 10-bagger is. It’s out there right now waiting to be discovered.

Two recent examples that spring to mind are Games Workshop and Best of the Best. Both are multibagging investments. I’ve struck upon many more disappointments than big wins - but you only need a few of the latter to materially transform the performance of your portfolio.

There are several features these quite different companies have in common:

- They were both small at the time of initial purchase with plenty of scope for growth,

- They were both high quality, with strong balance sheets, cash generation, and returns on capital,

- They both had a sense of stewardship and shareholder alignment that was clear from the management commentary, and

- They both had clear catalysts - with GAW it was a change in management, and with BOTB a pivot to an online only business model

Add to this double-digit historic growth rates (something GAW actually lacked back in 2016) and operational leverage and the result seems a reasonable framework for spotting similar opportunities in future.

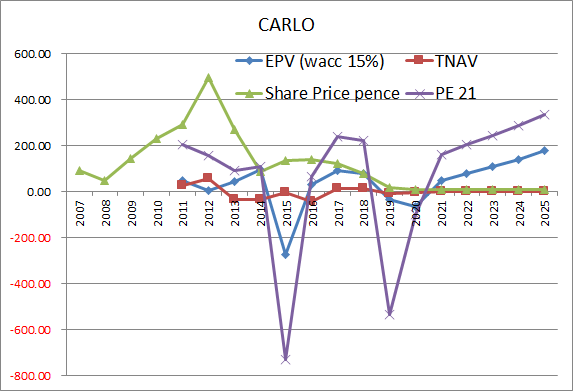

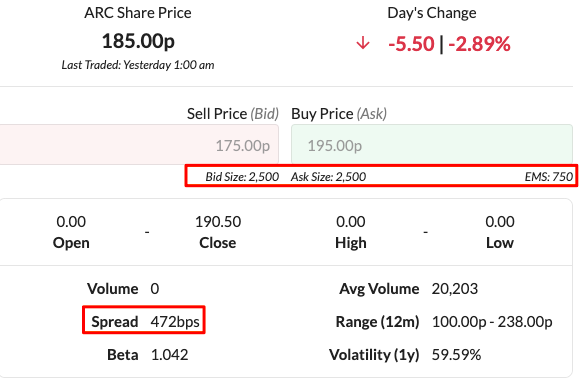

Arcontech (LON:ARC) might be one such contender. At a market cap of less than £25m, the stock is illiquid but if you believe that stock could treble then building a position over time is an option.

This is a small, fast-growing tech stock with positive relative strength, encouraging cash flow generation, and high double-digit growth rates.

I’ll explore just what it does below, but for now suffice to say ARC has some attractive operating characteristics.

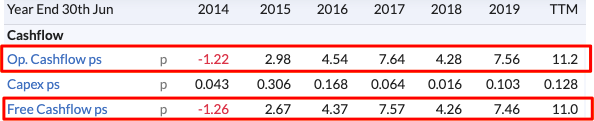

A high level of cash from operations drops straight through to free cash flow and shares stand to gain from operational leverage - if the company can continue to win new clients.

Revenue and profit have increased every year since 2010. What’s more, the balance sheet is strong, buttressed by a growing cash pile that management hints will be used on strategic acquisitions.

In fact as of one of its recent…

.jpg)