Merger and acquisition activity typically picks up at the late stages of equity bull markets, fuelled by optimism and the need of large companies to maintain earnings growth rates by any means possible.

So here we are, with debt financing rates still extremely low for large companies (see very low investment-grade credit yields), billions upon billions of pounds/dollars piled up at private equity houses seeking an investment home, and US tax reform delivering a profits bonanza to US companies.

Hardly surprising then that the desire for bolt-on acquisitions has grown, with a number of deals being announced this year alone in the UK market. The Japanese pharmaceutical company bidding £48/£49 for Shire is simply the latest in a series of such deals, Fox or Comcast for Sky being another.

I believe that now is a great time to be looking for takeover candidates to invest in. However, I apply one simple rule - I don't invest in a company simply because I believe it to be a potential target for an industrial or financial buyer; I only buy when the underlying fundamentals and valuation are also attractive.

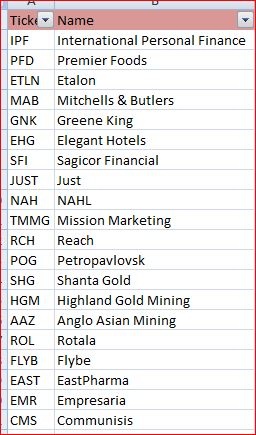

So here is my (non-exhaustive) list of companies that I consider to be potential candidates for industrial buyouts by (typically larger) competitors [note, I have invested in most of these]:

- Elegant Hotels (LON:EHG): Elegant Hotels seems attractive to me in that it is a Caribbean-based hotel group that trades still at a discount to book value, expects rising sales and has a 33% upside to consensus broker price target. Most importantly, approaches have already been made to buy the group by the Spanish hotel chain Sol Melia in the recent past.

- Revolution Bars (LON:RBG): Revolution Bars (written about at length by Paul Scott) continues to expand at a steady pace, has very little debt and funds new bar expansion via internal free cash flow, and looks set to recover to a double-digit return on capital. It has previously been bid for by pub/nightclub owners Stonegate and Deltic in the recent past (203p Stonegate bid was rebuffed by shareholders).

- Gocompare.Com (LON:GOCO): GoCompare continues to post strong top-line and EPS progression, and yet is only rated at a modest 13x prospective P/E for an online-based company with very…