Hydro International (LON:HYD) are a company all about water; they design and retail (outsourcing manufacturing) a number of products aimed at the controlling or cleaning of water, and sell them around the world - though overwhelmingly in UK and US markets. Here's the quaintly named 'Hydro Town', if you fancy a more detailed idea of exactly what it is they provide; and there's a video on their homepage detailing a flood-prevention scheme in Glasgow which shows one of their products. At first glance, then, I surmise two things about the markets in which operate. Firstly; I suspect, rather like Yougov and unlike Vislink, that the recession has seen a significant slowdown in demand. Glasgow City Council commissioned the flood prevention project, and it looks like U.S. municipalities commission much of their work over there. Rightly or wrongly, centralised capex has been tightened quite considerably given the fiscal situation recently. The commercial sector isn't exactly brimming with confidence, either - corporates always defer investment when things get ropey, and the sort of products Hydro provide strike me as being distinctly 'long-term benefit' as opposed to short term cost cutting.

Hydro International (LON:HYD) are a company all about water; they design and retail (outsourcing manufacturing) a number of products aimed at the controlling or cleaning of water, and sell them around the world - though overwhelmingly in UK and US markets. Here's the quaintly named 'Hydro Town', if you fancy a more detailed idea of exactly what it is they provide; and there's a video on their homepage detailing a flood-prevention scheme in Glasgow which shows one of their products. At first glance, then, I surmise two things about the markets in which operate. Firstly; I suspect, rather like Yougov and unlike Vislink, that the recession has seen a significant slowdown in demand. Glasgow City Council commissioned the flood prevention project, and it looks like U.S. municipalities commission much of their work over there. Rightly or wrongly, centralised capex has been tightened quite considerably given the fiscal situation recently. The commercial sector isn't exactly brimming with confidence, either - corporates always defer investment when things get ropey, and the sort of products Hydro provide strike me as being distinctly 'long-term benefit' as opposed to short term cost cutting.

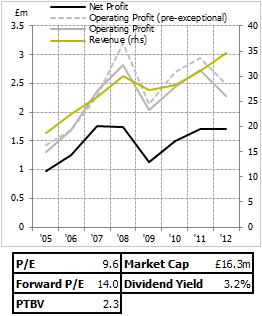

Over a decent time period, though, the company's been on the growth path - at least the last decade. The recession, while not plunging the company into the abyss of losses, saw what would probably be considered more of a stabilisation - net profits have centred around £1.6m for the last 6 years, in a reasonably tight band when it comes to the noisy world of earnings. The company is interesting from two perspectives, then. At first glance, if we were to look at a metric like EV/EBIT, the company is rather cheap indeed; the company has cash on book equivalent to about a quarter of its market cap, and a low level of borrowing. Net cash as of the interims was about £3m, though the cash figures are quite volatile. On the EBIT side of the equation, there's also a slightly favourable adjustment we can make. Much like last time, with Yougov - see the good discussion in the comments section about this, though - Hydro amortise some acquired assets at a cost of £0.2m on the income statement. I think this cost satisfies an accounting need but not an…

.png)