Morning all!

Hollywood Bowl ( Hollywood Bowl (LON:BOWL) ) – 183.5p – £275.3m – PER 13.7

Final Results For The 12 Months To End September 2018 – Revenue up 5.8% to £120.5m, PBT up 13.4% to 23.9m, EPS up 2.9% to 12.52p, Net Debt is down from £8.1m to £2.5m, Total Dividend is up 16.6% (Special Dividend of 4.33p (3.33p last time)).

Impressive enough but I still prefer Ten Entertainment (TEG), where I am currently Long.

Nexus Infrastructure ( Nexus Infrastructure (LON:NEXS) ) – 181p – £69.0m – PER 8.79

Results For The 12 Months To End September 2018 – In-line with a strong Order book (up 43%). Revenue flat, PBT up 24.8%, Net Cash up 7% (£20m), Basic EPS up 24% and the Dividend is up 4.8%.

This looks like a beat on estimates to me. A decent amount of Cash here and a decent yield, I will be checking for updated Broker forecasts here. Could be tempted to buy back in – I exited previously due to a bit of a profit warning (so that’s still at the back of my mind).

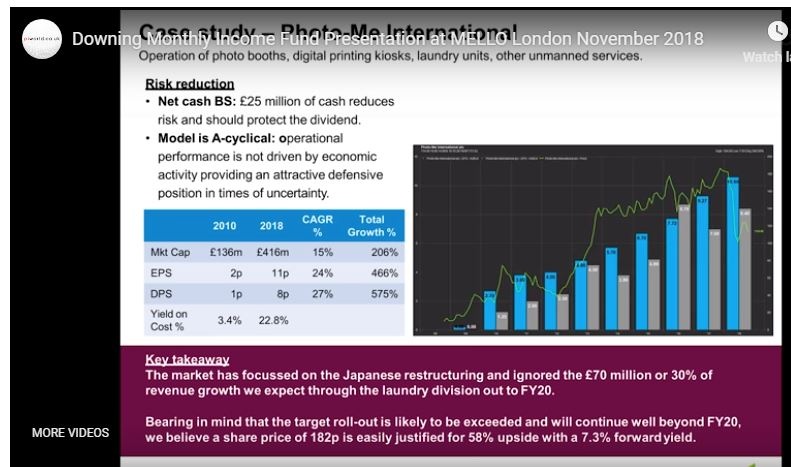

Photo-Me International ( Photo-Me International (LON:PHTM) ) – 106.2p – £401.2m – PER 10.8

Interim Results For The 6 Months To End October 2018 – Revenue down -1.7%, Adjusted PBT down -7.6%, Adjusted EPS down -3%, the Interim Dividend is the same as last year. Still highly cash generative and expects to meet previously stated 2019 FY guidance.

Nice yield, probably warrants a slightly higher valuation than this. I will wait to see how the FY looks.

Thruvision ( Thruvision (LON:THRU) ) – 26.9p – £39.1m – PER n/a

Interim Results For The 6 Months To End September 2018 – Revenue up from £0.3m to £3.2m, Loss reduced to -£0.8m (from -£1.7m last time). 60 units shipped versus 3 units last time – Has £12.6m in Cash (up from £11.7m). Trading in-line with management’s expectations.

A loss maker that is still currently on my Tech Screen – Will keep an eye out for updates on profitabiliy.

Van Elle Holdings ( Van…