Morning all!

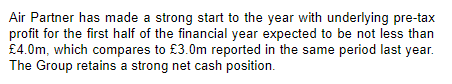

Air Partner (AIR) – Trading Statement – 6 Months To End July 2017 – I like this statement…

And this one...

I hold a long position in this share – I like this update and will continue to do so.

Camellia (CAM) – Interim Results – 6 Months To End June 2017 - Here are the notes I made on this company yesterday – This is a company engaged in agriculture, banking and financial services, engineering, food service and investment. It’s a company that makes a profit, then doesn’t, a company with a low ROCE, a tiny Dividend and one that has gone nowhere in 5 years (check the chart). I have no interest in companies like this until I see something transformational, something that might get it out of that 5 year rut. These interim results state Revenue is up 20% or 10% if you take out the exchange rate benefit. PBT (continuing operations) is £1.9m versus £6.8m LFL. Cash now stands at £98.7m vs £53m at the same time last year and the Dividend has been increased by 5.7%. Hardly transformational!

Henry Boot (BOOT) – Interim Results For The 6 Months To End June 2017 – This land development, property investment and development, and construction company actually ticks a lot of my boxes. Just check out the CAGR - Revenue, Profit and EPS, all 20%+. Recent ROCE is consistently above 10%, the modest 2.5% or so Dividend is well covered and Debt is less than 10% of Mkt Cap. Although Revenue is up 82% these results seem to disappoint a little with a general LFL 10% growth elsewhere, Profits, EPS and Dividend. This share is up 50% YTD but I suspect this below par update may now hold it back a little. Good to see increased Revenue +82% but following it up with a +10% growth in Profit is off putting to me - Perhaps there’s a valid reason for this but I couldn’t find it in my limited time morning scan. Might look later as it did seem interesting before this update.

ITM Power (ITM) – Final Results For The Year To End April 2017 – This stock is up 50% YTD but it’s not one for me. It’s very rare I…