Morning all!

Bioventix ( Bioventix (LON:BVXP) ) – 3600p – £185m – PER 29.3

Interim Results For The 6 Months To End December 2018 – Revenue and PBT up 24%, Cash at £5.5m (£5.6m last time), Interim Dividend up 20%.

I keep missing out here always thinking it looks too expensive. I guess I will just sit and watch it go higher as I always consider it too expensive!

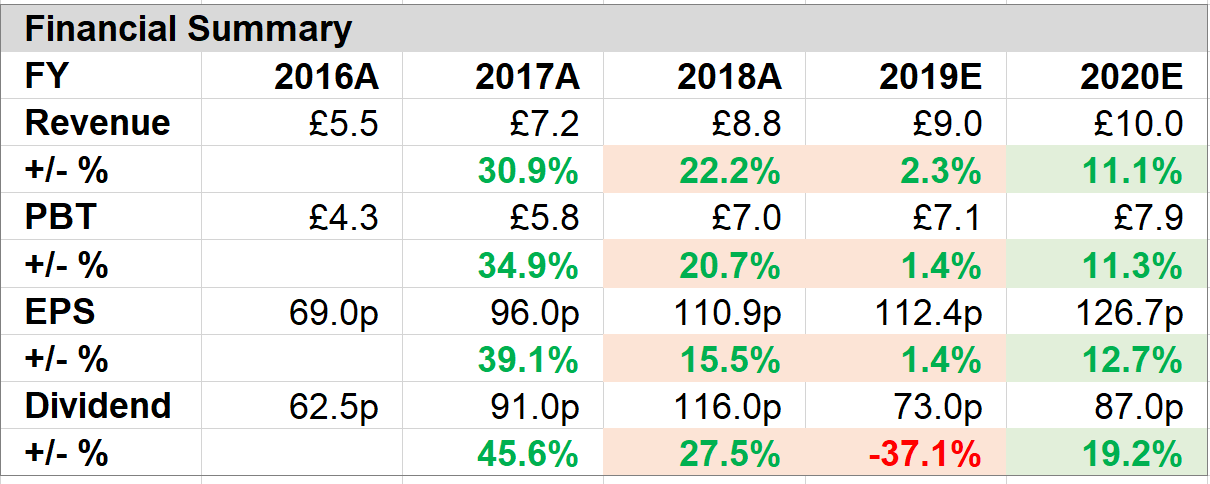

Numis ( Numis (LON:NUM) ) – 255p – £271m – PER 11.1

Trading Update For The 6 Months To End March 2019 – Revenue expected to be -26% lower than last year – Challenging but pipeline stronger in recent weeks.

Too "lumpy" for me to get involved here again at present, possibly ever!

As always, all comment most welcome!