Morning all!

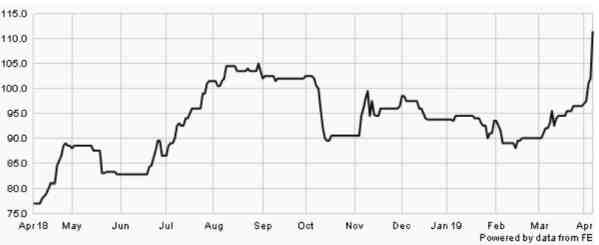

Castleton Technology ( Castleton Technology (LON:CTP) ) – 112p – £91m – PER 16.4

Trading Update For The 12 Months To End March 2019 – FY to be in-line.

Insiders liked this as the price was up almost 10% on Friday. I also quite like it and any upgrade to forecasts would make me consider a purchase here – It's on my Watchlist.

VP ( VP (LON:VP.) ) – 995p – £399.5m – PER 9.9

Trading Update – Expects FY to be well ahead of last year and in-line with current market expectations.

I had this to say last time and I reckon it's still valid "Still some attraction here but the Net Debt is enough to keep me Neutral at present".

As always, all comment most welcome!