IG group (LON:IGG) is a stock that I’ve been involved with for quite a long time: over a decade.

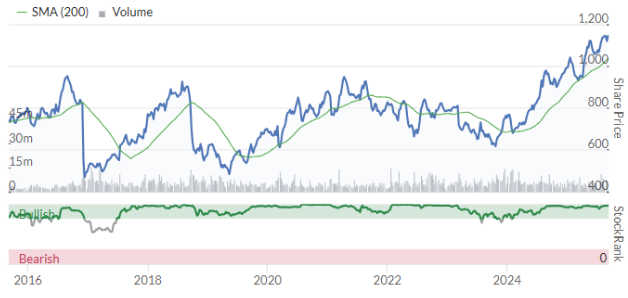

It has faced various challenges over this time, but the chart suggests that the company has been broadly successful:

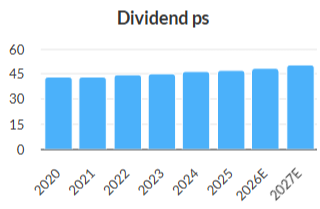

It has paid a regular, and usually growing, stream of dividends for the past twenty years, which has been an important part of total return.

At today’s valuation, the yield is slightly over 4%, and the P/E ratio is 10x. Not bad for a stock trading at its all-time highs!

In this article, I'm going to explore why I remain a fan of this FTSE-250 stock.

History

IG has its origins in the 1970s and the exchange controls that prevented individuals from speculating on the price of gold.

In that environment, businessman Stuart Wheeler created Investors Gold Index, later shortened to IG Index. Customers could now trade on the price of gold using the innovation of spread betting, and of course it wasn’t long before the company expanded to offer spreads on a wide range of instruments.

The company continued to be called IG Index until 2012, when it dropped the “Index”.

Throughout its history, IG has been the main platform used by traders in the UK for spread betting and CFDs.

Modern profile

These days, IG is not just at home in the UK. It’s truly international, earning almost as much revenue in the APAC/Middle East region as it does in the UK. Here is the revenue breakdown for FY May 2025:

UK and Ireland: £297m

APAC/Middle East £259m

US: £166m

Europe: £134m

Institutional and Emerging Markets: £87m

Core to the business is what it refers to as “OTC” (over-the-counter). This refers to trading in instruments away from exchanges and in the case of IG means the products that it has designed itself, i.e. the various instruments on its spread betting platforms.

The beauty of this business is that IG charges customers a spread, but it often doesn’t have to pay a spread of its own. The reason for this is (in the words of its most recent Annual Report), "the vast majority of trades offset as customers take opposing positions”.

This results in something called “Internalisation”: there…