I discussed Impellam last year and found them rather perplexing as a group. I can't see any reason for them to trade at the value they're sitting at, and, even if you dislike recruiters (which is probably a fair bias) I couldn't see why they weren't at least trading in line with other similar companies. My perplexion has not been answered or changed - they actually trade at slightly less than last time, though only marginally. So what's changed since I first looked at them?

I discussed Impellam last year and found them rather perplexing as a group. I can't see any reason for them to trade at the value they're sitting at, and, even if you dislike recruiters (which is probably a fair bias) I couldn't see why they weren't at least trading in line with other similar companies. My perplexion has not been answered or changed - they actually trade at slightly less than last time, though only marginally. So what's changed since I first looked at them?

From then to now

Well, two big things. Firstly, Cheryl Jones, Chairman (they don't have a CEO), stepped down. It seems rather sudden, and the company is doing what it always seems to do and not giving a great deal away - just saying that she's leaving "following the successful turnaround and transformational restructuring of the Group". Kind words, and probably fair ones, but still a little strange. In hindsight, I wonder whether investors are skeptical of the corporate governance issues of having such a small group of directors and a combined CEO/Chairman; that hasn't changed since her departure.

Secondly, though, we've had the trading update and Impellam's expectations for the year, along with an interesting announcement. The announcement first, and the group said that the Board is considering a "one off special dividend of not less than £15.0 million following release of the preliminary statement in February". The dividend is a few million already, so we're looking at the group returning about 13-14% of its current market cap in cash to shareholders. They've already been buying up shares and have continued to be cash generative, with a small amount of debt.

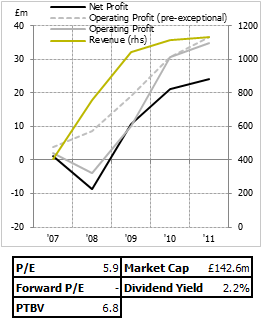

The expectations for the year are pretty reasonable, too - £3m less in operating profit than last year (£36.7m pre-exceptional 2011) puts us about £34m, and they say share options charges and restructuring costs will add a £5.5m bill on top of that. Post exceptional profit should come in, if they're accurate, at about £28m, then. Deduct net finance costs and tax and you're looking at maybe £20-24m net profit for the full year, putting them on a forward P/E of about 7. And that's post exceptional, though I don't think share option charges are actually 'exceptional' at all (particularly given Impellam were talking about issuing more), so it's highly dependent on how much…

.png)