News this week that Imperial Brands is ditching a long held policy of hiking its dividend payout by 10 percent every year didn’t come as much of a surprise.

For many years, the blue-chip that used to be known as Imperial Tobacco has been a stalwart income share. It has been part of the UK’s dividend landscape, with big, reliable and growing payouts (assuming you could stomach its ‘sin stock’ status).

But as the market for cigarettes has changed, so too has Imperial’s ability to keep up with that policy of double-digit payout growth. The market has long suspected that there was trouble ahead. Imperial’s share price has halved over the past three years. In part, that’s pushed up the yield on the stock from 3.6 percent to 9.8 percent.

It looked attractive, but it had the tell-tale signs of a dividend trap.

To put a stop to this price decline, and get the bad news into the open, Imperial has uncoupled itself from its previous policy. From 2020, rather than a guaranteed 10 percent rise each year, payouts will be linked to earnings growth. This is a major change of gear for a business that was once a cash cow. It’s now having think more innovatively about where future cashflows - and the associated dividend payouts - will come from.

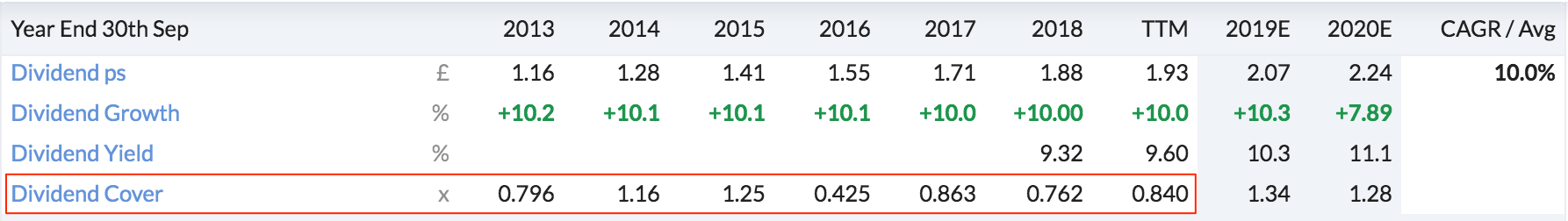

From an investment perspective, changing market conditions haven’t yet washed through Imperial’s financials. But while the dividend growth rate has remained intact in recent years, its dividend cover (its ability to cover the payout from current year earnings) has turned negative - and that was one of the early warning signs.

In practice, Imperial may remain a solid income growth stock. As long as the payout continues to rise (even if not at the same 10 percent rate), it’ll likely stay one of the market’s popular ‘dividend achievers’.

But for investors looking around for other options, there is a club of stocks in the market that have managed more than 9 years of dividend rises with a long run average growth rate in excess of 10 percent. The Dividend Achievers screen that we track is one of the better performing income screens over five years (although these screens have had a tough time over the past 12 months).

…