Another month, another inflation figure well above "target": "UK Consumer Prices Index (CPI) inflation remained unchanged in September at 3.1%, according to the Office for National Statistics (ONS). The Retail Prices Index, which includes a higher proportion of housing costs, fell back slightly to 4.6%".

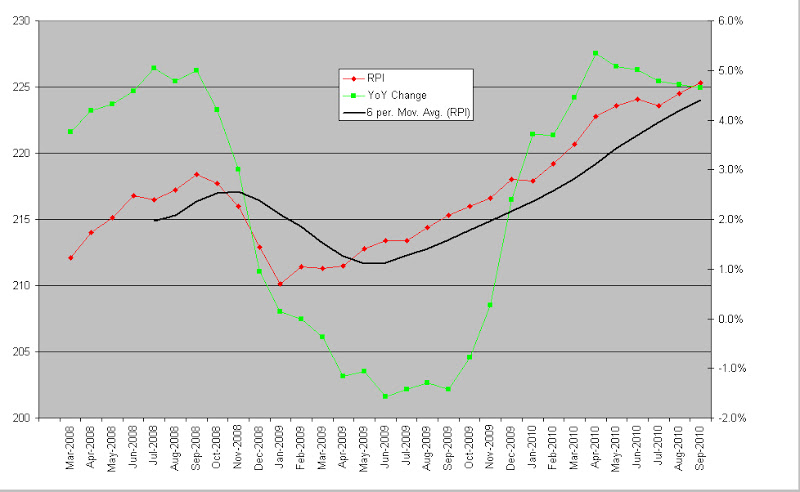

It occurred to me some time ago that the reported UK inflation rate doesn't actually give a very clear picture of what's really going on. That's because it represents a first derivative of average prices, rather than showing the actual prices. So, I've been plotting the actual RPI number:

Click here for enlarged view.

Red line represents the RPI index value (left hand scale)

Green line is the "headline inflation rate" (right hand scale)

Black line is a trend line (moving average of the index value)

One can see quite clearly from this that the headline inflation number (green line), reported in the press, appears to have gyrated quite wildly and now seems to be high but slowly settling back. What really happened, however, was...

Prices declined for a brief 4 month period during the depths of the global financial crisis (GFC). Ever since January 2009, however, they've resumed a very steady upward climb. The implication is that the UK has been in a period of stagflation since then, with inflation running much higher than feeble nominal growth. This appears to have given the lie to the economic theory that underutilisation of capacity would hold prices down, possibly leading to deflation. Rather, as I had suspected, political pressure to debase the currency, effectively defaulting on sovereign debt, has won out. Of course, one always has to bear in mind that the past isn't necessarily a guide to the future, but in this case I think I have the lessons of history on my side (I commend Niall Ferguson's "The Ascent of Money").

This has particularly serious implications for savers: we're back in a 70s style era where cash held in bank accounts (except on a short term basis) is earning negative real interest. If you want to preserve your wealth, you can no longer just leave your cash in the bank (but, of course, must remain very alert to the risks of other forms of investment).

One investment you might consider is index linked gilts. I have around 10% of my SIPP invested…