This article was written by regular contributor Anton Crabbe. You can read his bio here

Infomedia (ASX:IFM) is a company I have admired for some time now as fundamentally, they are a fantastic company.

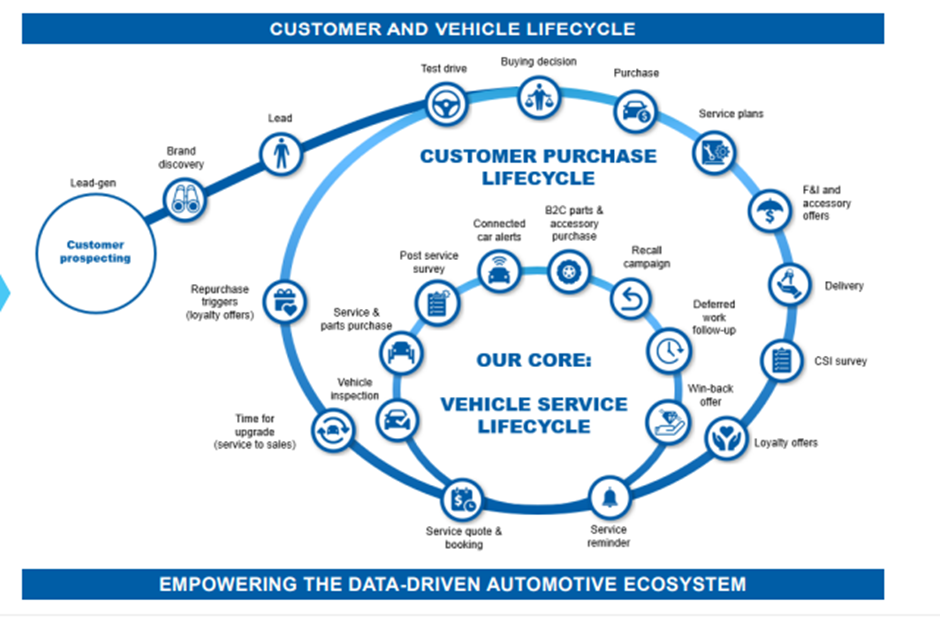

They are a global player in the automotive industry providing SaaS (Software as a service) and DaaS (Data as a service) products to car manufacturers, dealers, and OEM’s. Over the years their business has evolved from mainly a parts and inventory software provider to offering a full suite of SaaS and DaaS products that provide analytical, marketing, predictive servicing, parts inventory, and maintenance solutions. All this is aimed at capturing the global trend in connected cars and allowing car manufactures and dealers to own the lifecycle of a customer/car relationship by providing pre-emptive servicing, repair/maintenance and resale solutions and recommendations. A large part of the connected vehicle market is expected to come from the growth in EV sales, as the push to decarbonisation marches on.

https://www.infomedia.com.au/files/investors/230224-IFM-1HFY23-Investor-Presentation-Slides.pdf

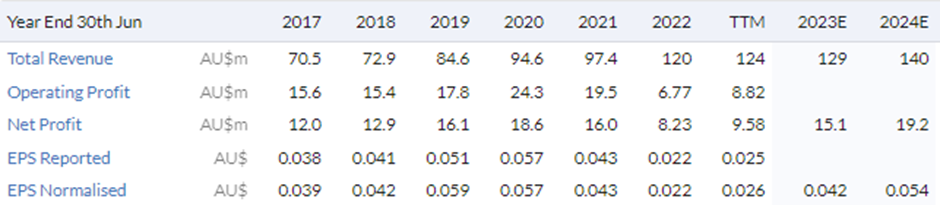

To date this transition has not been a smooth ride for IFM. They raised capital back in 2020 to fund acquisitions and software development costs associated with the new strategic direction. There have been changes at board level, namely the appointment of a new CEO at the start of 2022, and there was a small thing called COVID which threw a spanner into the entire car supply chain.

As a result, sales flatlined and earnings and profits declined. But now they are starting to increase and pleasingly as a result of the new business strategy, the majority of IFM’s revenue is contracted annual recurring revenue (ARR). It’s looking like the worst is behind IFM and now they are focused on reducing costs, growing sales, market share and profits.

Stockrank/Quality Value:

The numbers tell the story here, IFM is a quality company which is reflected in a quality score of 99 but this is no secret to the market or investors with a valuation score of 22 and momentum at 90. Momentum does seem to be on IFM’s side currently, which does help explain the 20 cents a share price increase since the start of 2023. If we go back to…