For years – since interest rates hit lows after the global economic crisis in 2008-2009 – investors have been waiting for interest rates to rise.

Periodic murmurings by the Federal Reserve, the American central bank, about interest rates have been enough to send markets into a tailspin (remember December 2015?).

But if you’re still waiting for the Federal Reserve to finally raise interest rates back to a ‘normal’ level, you’re in for a long wait.

That’s because despite the latest hike in June, to a target range of 1 to 1.25 percent, there aren’t going to be many more interest rate hikes in this economic cycle.

Over the past 40 years, the Fed funds rate has averaged 5.3 percent. Over 30 years, the average is 3.65 percent. But it could be another decade before we see those kinds of Fed rates.

This could have profound implications for every investment decision you make.

Here’s why…

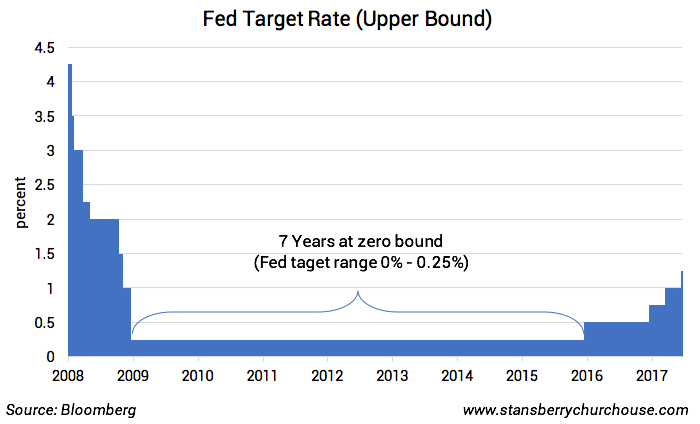

In December 2008, in the depths of the global economic crisis, and as the U.S. slipped into recession, the Federal Reserve under Chairman Ben Bernanke lowered the key Fed Funds Target rate to zero percent.

(The Fed funds rate is one of the most-watched interest rates in the world. Specifically, this is the interest rate that banks charge each other for overnight loans. It is a set by the Fed as a “range”. When people talk about “the Fed raising interest rates,” they’re really talking about the Fed funds rate.)

It wasn’t until December 2015, seven years later, that Fed head Janet Yellen raised the benchmark target range by 0.25 percent.

Since then, the Fed has implemented three further 0.25 percent rate rises (the latest being earlier this month) against a backdrop of falling unemployment (now at 4.7 percent, down from 5 percent in December 2015 when the first rate hike was made), and slowly rising economic growth.

But there’s every reason to believe that we are nearing the end of this tightening cycle.

Take a look at the chart below. It shows the market-implied future Fed funds rate from today, to three years in the future. These rates are what the market currently predicts the Fed funds rates will be in the future.

The market is telling you that three years from today, the implied Fed target…