My wife will shortly receive £50k from the proceeds of her mothers will. She would like to draw a small income from it, and I am interested in the views of people here on what approach they might take. I know there are many other factors to take into account so I will just list what I think are important.

She has no pension income other than what she will receive in 4 years time when she will be 66

We could live off my own pension income (SIPP in drawdown), so we are not really reliant on income from her £50k

She is very risk-averse, I am not.

She is talking about putting most of it in premium bonds, but already has £20k invested in Premium Bonds.

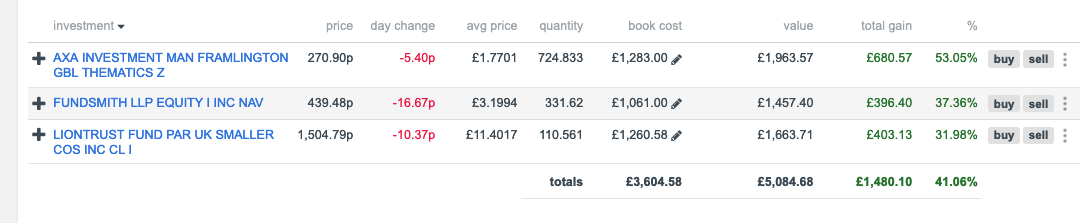

I have been thinking she might be wise to look at Investment Trusts that provide a regular income, say 4% per year.