You might think 2020 is not the year to float your company, but the truth is there are a few recent IPOs on the market. In fact by my counting, there have been close to 20 this year. That’s lower than last year but it’s still plenty of new entrants.

There is a wariness around IPOs - why buy something being sold to you by investment bankers when they have much more information than you do? But there are always exceptions to the rule, and every once in a while this lack of information can result in a great opportunity for the diligent investor.

Here are some of the more notable IPOs this year in order of listing date:

Name | Sector | IPO date | Market Cap | IPO Price | Share Price | % Performance |

Consumer Cyclicals | 07/01/2020 | £38.16m | 30p | 22p | -26.7% | |

Industrials | 12/02/2020 | £1,150m | 240p | 208.6p | -13.1% | |

Healthcare | 27/02/2020 | £268m | 195p | 265p | +35.9% | |

Industrials | 06/03/2020 | £243m | 80p | 101.75p | +27.2% | |

Industrials | 23/03/2020 | £150.7m | 0.68p | 0.48p | -29.4% | |

Basic Materials | 31/07/2020 | £82.8m | 45p | 45.45p | +1% | |

Technology | 21/09/2020 | £6,090m | 500p | 670.6p | +34.1% | |

Consumer Cyclicals | 25/09/2020 | £59.2m | 73p | 66.5p | -8.9% | |

Technology | 05/10/20 | £90.6m | 48p | 99.8p | +107.9% |

We covered Inspecs (LON:SPEC) here although it’s safe to say, with everything else going on this year, I haven’t kept up with developments. The group announced a £64m placing on 19 November that will be used to help pay for the £84.7m acquisition of Nuremberg-based eyewear supplier Eschenbach.

That’s a material development for the £268m market cap Inspecs and is probably worth a closer look in itself. But for now I’d like to focus on Calnex Solutions (LON:CLX) - the clear standout from the list above in terms of share price performance.

Calnex (LON:CLX)

Share price: 99.8p

Shares in issue: 87,500,000

Market cap: £87.3m

Calnex makes hardware and software solutions that test the performance of critical telecoms and data network infrastructure. It’s an important function in a rapidly evolving and expanding industry, and Calnex is trusted by many of the world’s leading operators.

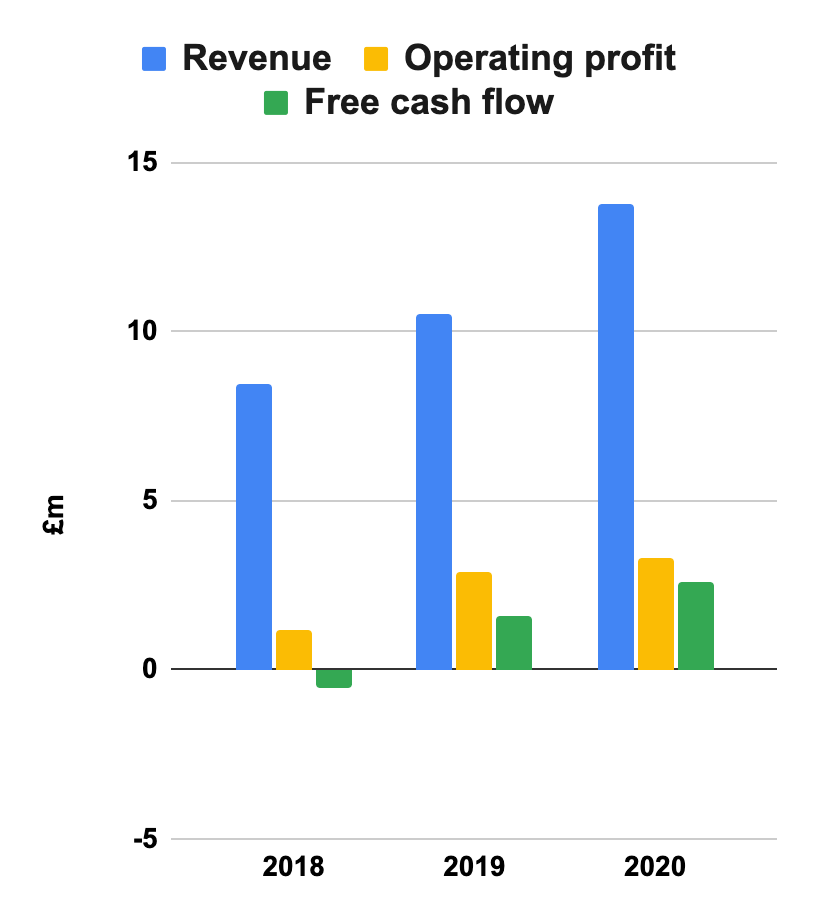

We can see revenue, operating profit, and free cash flow are all growing at decent rates (albeit over just a three-year time period):

It is profitable, cash generative and entered FY21 with a record order backlog. That sounds promising - my only real question right now is: is it too expensive after a 100% rise, or is there still plenty of upside left on the table?

The group has a Value Rank of just 17 and,…

.jpg)