Hi all

I have no position in IQE, however it is evident that it is very well followed by stocko subscribers. I have CC this piece from share profits apologies if already common knowledge. I also have the full report if anyone wants a copy message me your email address. (Don't think i can attach to post?)

FYI

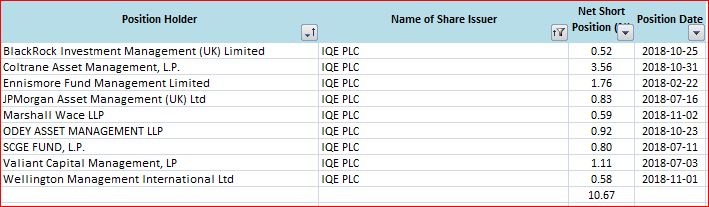

Legendary US bear raiding outfit Muddy Waters has announced that it is short of IQE (IQE). It dismisses Matt Earl's Shadowfall dossier of last week as only partially getting there and has published its own devastating report slating IQE as an "egregious accounting manipulator". Don't mess with Muddy Waters, anyone out there still owning this stock should sell NOW!. Muddy notes:

Muddy Waters Capital LLC (“Muddy Waters”) is an investment advisor to private funds. Muddy Waters has analyzed the U.K.-listed company IQE plc (“IQE”) and is hereby publishing the outcome and the conclusions of our analysis, which is based on publicly available information. Funds Muddy Waters manages are short shares of IQE and for this reason there might be a conflict of interest.

Muddy Waters is Short IQE plc (AIM: IQE LN)

Muddy Waters Capital LLC is short IQE. IQE is, in our opinion, an egregious accounting manipulator. We adjust downward the company’s reported net income for 2015 and 2016, respectively, by 58.5% and 25.4%. We believe it is reasonable to adjust 1H 2017 net income down by approximately £5 million or 69% to account for likely aggressive capitalization of expenses.

The 2015 and 2016 adjustments reflect our belief that IQE’s transactions with CSC are not substantive, and the accounting is possibly designed to deceive investors. We estimate that when IQE booked gains on transferring PP&E to CSC, it transferred the PP&E at a valuation 4.6x carrying value. This markup strains credulity. We call upon IQE to release the purportedly independent valuation report in full, and we will publicly opine on it (even if it convincingly supports the valuation). IQE was CSC’s only customer through 2016, and CSC generated an abysmal negative -105.9% gross margin! (It is almost amazing anyone would claim that it “holds itself to the highest standards of corporate governance, transparency, and integrity” with a straight face under these circumstances.)

We identify five previously unknown issues with the accounting for transactions between…

Hi All

It’s been a turbulent week for £IQU. I was wondering how investors were responding to the news flow as the share price stabilised today. I carried out a quick search via Hargreaves Lansdown into the share trades and volume as it can be a good time to buy if a share isn’t responding poorly to bad news.

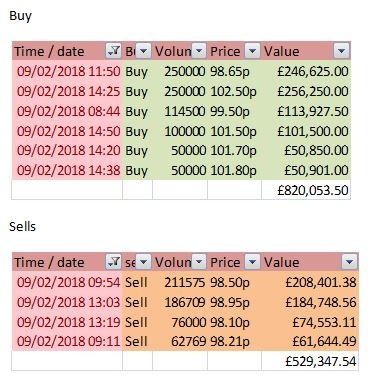

This is the result

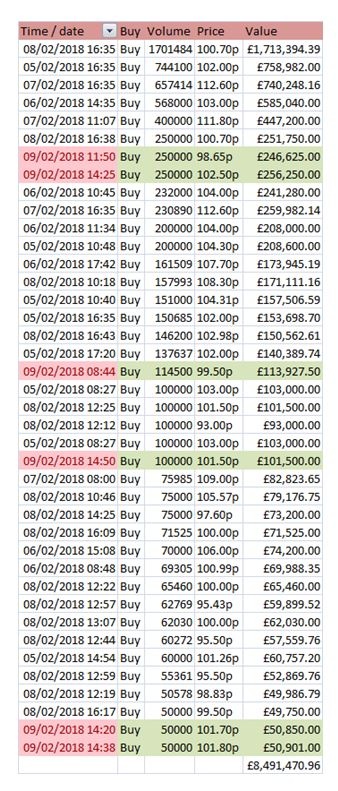

Buys

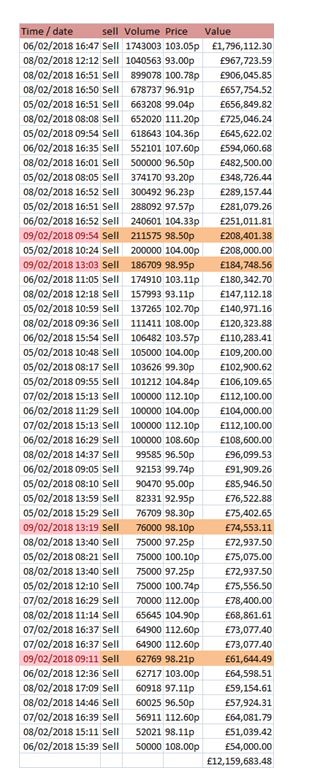

Sells

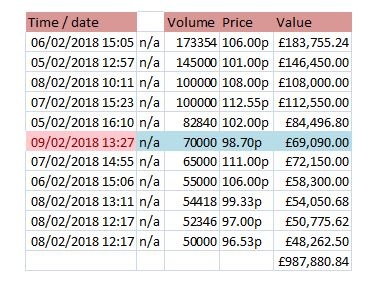

and N/A

So, £12,159,683.48 Sells and £8,491,470.96 buys with £987,880.84 unaccounted for N/A

That equates to £3,668,212.52 net sellers. However you would have expected some follow through from the sellers today with it being the week end. However if we look at today’s volume things are presented slightly differently. Today’s volume data is highlighted as follows, green buy, orange sell and blue N/A. Let’s take a closer look

With 69,090.00 N/A

That works out at a buy/sell ratio of 1.54917788 on what potentially should have been a bad day!

Will be worth viewing closely in the coming days to see if share price starts rising and potentially start forcing a short squeeze.

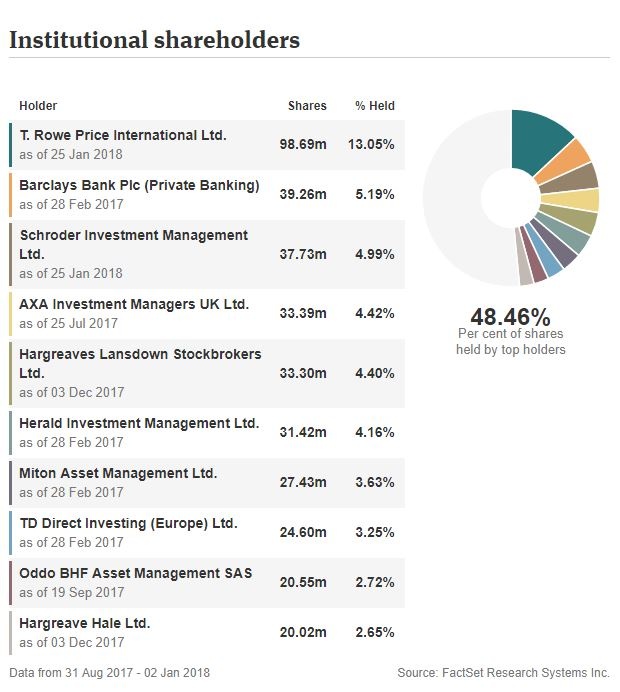

IQE is reasonably well supported with institutional ownership and it will be interesting to see what their response is Buy, Sell or hold. Keep an eye on what Hargreave Hale do as Giles Hargreave is one of the most astute small cap fund managers around. (Institutional ownership source of information Investors Chronicle)

All the best J