I’m just finalizing my review of The Great Irish Share Valuation Project (TGISVP) for 2012. My end-Q3 review is here & here for reference (and this post’s relevant also – it may even offer some interesting commentary on general stock selection & valuation). In this post I’ll cover last year’s winners & losers.

NB: FY 2012 performance is TGISVP specific, i.e. it’s only measured from the specific date I set a target price for each stock in Q1 2012. [Apologies if you'd prefer actual FY 2012 stock performances - but I'm sure there would be a high degree of overlap, anyway]. There’s no M&A to highlight for Q4 – the only items of note are i) United Drug (UDG:LN) abandoned its Irish listing in favour of London, and ii) Elan (ELN:US) spun out its drug-discovery unit, Prothena Corp (PRTA:US) – but the impact for shareholders was minimal.

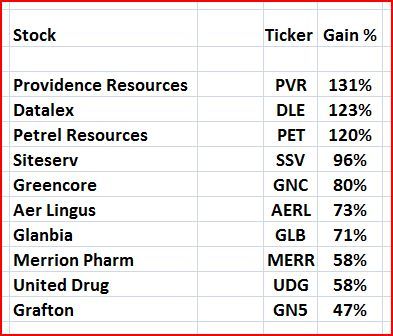

Here’s the 2012 Top 10 Winners:

Hmm, my pick of the winners looks like a real coin toss – I was only bullish on half these stocks! [Wait for my next post to see how I did overall with TGISVP, despite this...]. Now I look again, I actually own none of these winners. Crikey, how on earth did I even manage a (measly) +20.2% performance on my Total Portfolio last year?!

Providence Resources is the only genuine resource stock winner here. It now carries a a heavy weight on its shoulders – the hopes & dreams of investors who’ve lost buckets on other resource stocks! Proving I’m not a permanent resource stock bear, I was reasonably bullish on PVR. Obviously my valuation was risk-weighted, so actual/continued success with its Barryroe discovery prompted PVR, not surprisingly, to run well ahead of my price target.

I was also bullish on Datalex & United Drug, but under-estimated their popularity. I’ll admit my DLE valuation was conservative, reflecting the company’s small size & low level of profitability. In reality, underlying profitability could be far higher, but it’s absorbed by continued investment & contract acquisitions. In all likelihood, a takeover’s needed here to crystallize DLE’s ultimate valuation, but that may still be some years away (quite rightly). On the other hand, I expect United Drug…