G’day All Value Contrarian Investors :-)

Maybe a bit late in asking … as I have now bought some already :-))

But as I am always learning … and I may have missed something … can anyone spot any reason why Australian stock Southern Cross Media (ASX:SXL) is possibly NOT a good long term (1 year+) contrarian value buy?

It’s valuation numbers etc all look good for a good quality value stock?

It’s QV Rank is 95 on Stockopedia.

It’s dividend yield looks to be around 9%

Hell, it’s even got a reasonable PEG ratio :-))

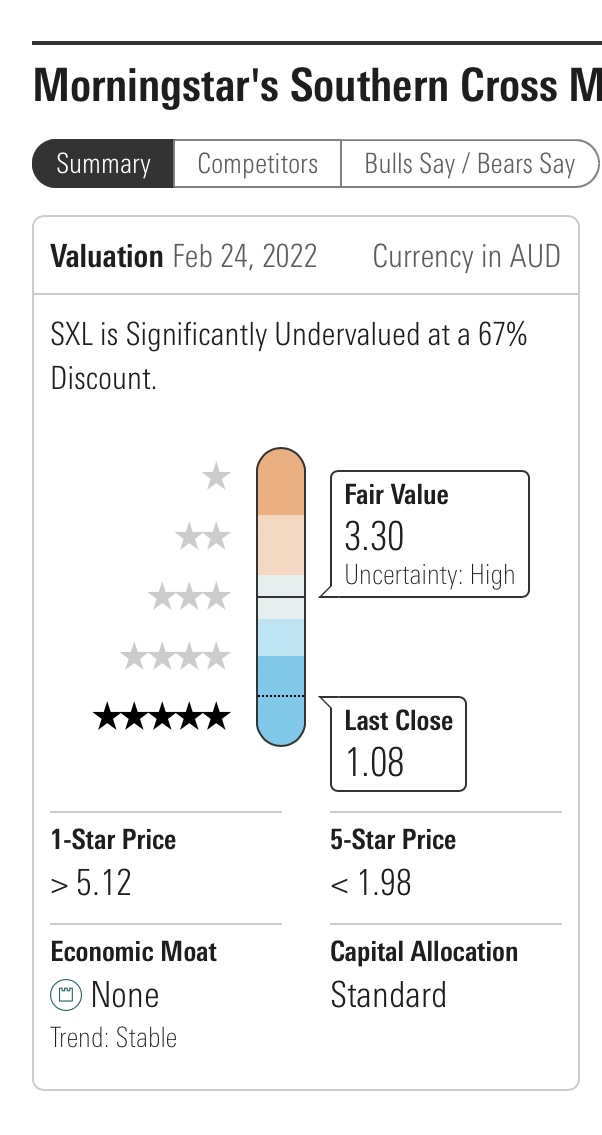

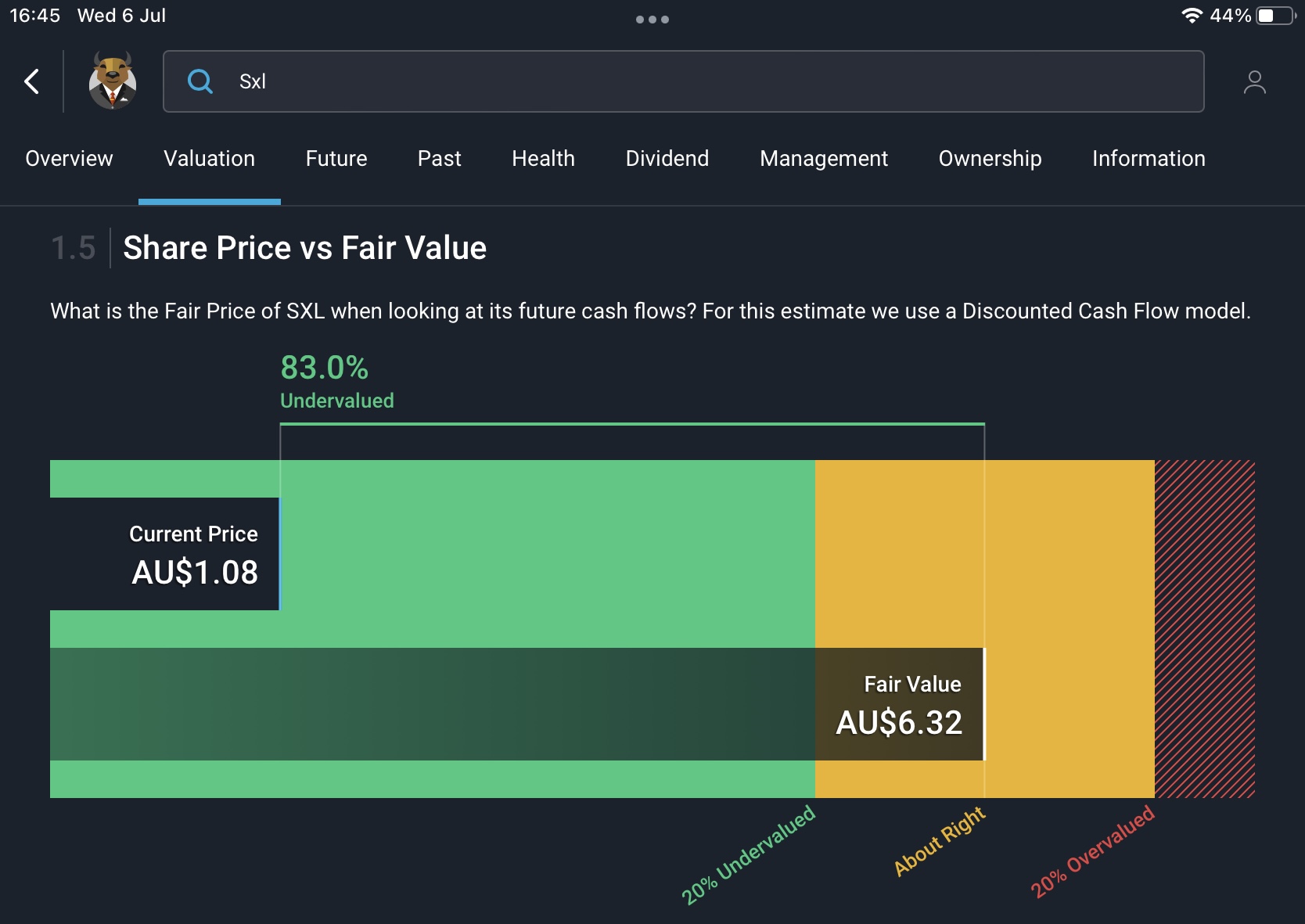

Morningstar and Simply Wall St both think it is way over sold? - see screenshots below.

Thanks in advance:-))