Can changes to a company’s StockRank and factor ranks be used as an early warning sign of possible problems ahead?

Some recent examples have made me think this area could be worth examining. In this piece, I’m going to consider two case studies before taking a broader look at the data behind this issue.

Case study #1: Bunzl

On 16 April I covered the profit warning from FTSE 100 distribution group Bunzl (LON:BNZL) in the daily report. What struck me most at the time was the way that the company’s StockRank had fallen sharply in March following its full-year results:

The annual results had received a poor reception from the markets, but the headline numbers did not seem to flag up any obvious concerns. Profits and margins were broadly stable.

With hindsight, the problems that triggered April's profit warning were mentioned in management commentary. Even so, brokers had only made a slight cut to full-year forecasts – not necessarily a big concern for a mature and reliable performer like Bunzl:

(Bunzl: 8 March 2025)

However, April’s profit warning subsequently led to a much more severe cut to profit forecasts – and a 25% one-day share price drop that I’m sure some shareholders would have liked to avoid:

(Bunzl: 5 May 2025)

Checking back through the StockRank history, a clear pattern emerged. While Bunzl’s QualityRank and ValueRank have remained broadly stable, its MomentumRank fell sharply following its results and has fallen further since then.

22 Feb 25 - High Flyer - the MomentumRank was high prior to its results (share price 3,336p):

Bunzl’s 2024 results were published on 3 March 25. By 8 Mar 25, its style had fallen to Neutral and the MomentumRank had fallen sharply (share price 3,076p):

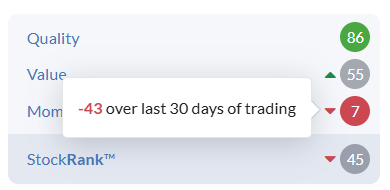

The company’s Q1 trading update and profit warning was published on 16 April 25. Here’s how Bunzl’s QVM ranks looked two weeks later, on 5 May 25 (share price 2,380p):

The dominant theme is the rapid decline of Bunzl’s MomentumRank, which has fallen from 93 to 8 since…