African telecoms operator Airtel Africa (LON:AAF) joined the FTSE 100 at the end of January, but as far as I can see, it hasn’t yet gained much of a following among UK investors.

Despite this, this emerging markets business has proved to be a much more profitable investment over the last couple of years than its more popular FTSE peers, Vodafone and BT Group.

In June 2021, I added Airtel Africa to my rules-based SIF model portfolio here at Stockopedia, and to my personal holdings. The stock has since become SIF’s top performer and (nearly) a two-bagger for me.

I’m keen to preserve these gains if possible, so this week I’m going to take a fresh look. Can this stock continue to perform well after such a strong run?

Airtel’s QVM factor scores certainly continue to look favourable:

At a macro level, I’m also bullish on the medium-term growth outlook for the African telecoms and mobile money sectors. However, even if I’m right, that doesn’t necessarily mean that Airtel will be able to maintain its straight-line profit growth without any blips.

Are there any clouds on the horizon? Let’s take a look.

Money+data = unstoppable growth?

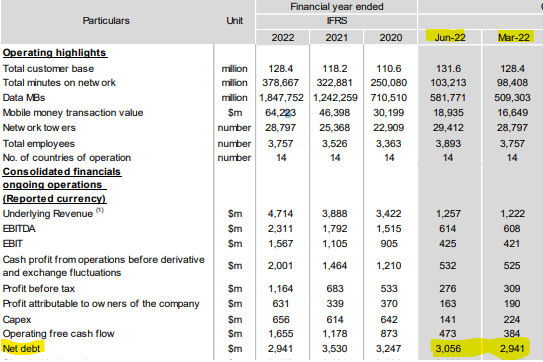

Airtel Africa is the second-largest telecoms operator in Africa. The group has 132m customers spread across 14 countries. Airtel’s customer base includes 47m data users and 28m mobile money users.

For comparison, Vodafone has 185m African mobile users and 90m data users.

Airtel’s management expects the group’s addressable market to expand from 267m unique users in 2020 to 346m by 2025. This growth is being driven by urbanisation and population growth, but also increasing adoption rates.

According to Airtel’s website, just 46% of the population in operating markets own a SIM card. A 30%-50% increase in users seems quite plausible to me – something that would be impossible in the saturated markets of Europe.

The group’s latest results showed a 9% increase in customer numbers during the year to 31 March. Within this, the number of data users rose by 15%, while the number of mobile money users rose by 21%.

I expect to see growth in data and money service usage continuing to outpace overall user growth. These products provide affordable access to information and…