1. Does Europe offer better investment prospects than the UK?

2. If so, what European companies small and large offer the best returns?

Currently my portfolio is a mix of medium to large US and UK small caps with greater weighting on the latter. With the UK seemingly locked in to poor economic data and my portfolio underperforming as a result I wanted to open up a discussion thread on where I should look to in the European markets. Edmund Shing and Ed have previously offered positive views on investing in European companies.

You certainly won't go wrong by investing in Europe. The EU is an economic powerhouse with many high quality growth companies combined with a relatively undiscovered and illiquid market which can make it a great hunting ground for value investors too.

To get a better understanding of what works well by market cap, you can use this tool on Stockopedia's site:

https://www.stockopedia.com/le...

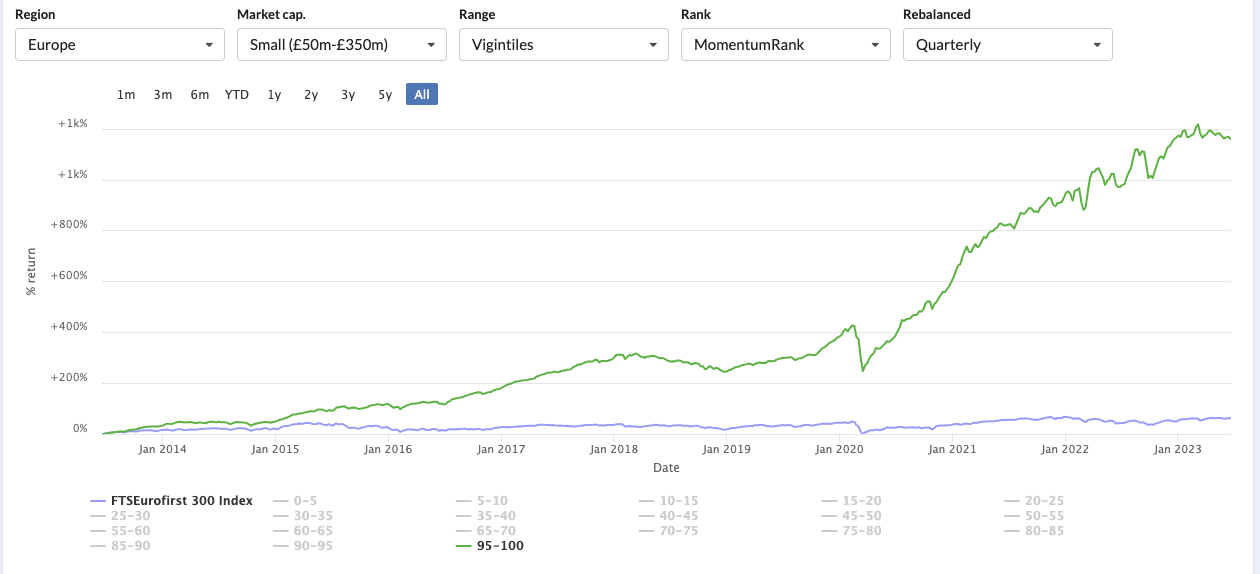

You can switch between different market cap segments and different stock rank styles. The Small cap Momentum performance (image above) is nothing shy of remarkable. There has almost been no drawdown in 2022 and it's produced a 28% annualised rate of return since inception. UK small cap momentum has produced a 20% annualised rate of return, in comparison.

This should be a good starting point for further research, but generally speaking, Europe and the UK share a similar factor returns profile. i.e. VM and QM work very well and small caps/mid caps hugely outperform large caps. Unlike the US, where institutional investors favour growth (CAN-SLIM), so you need a GM approach to be more successful over there.

However, the key issues you may face are:

1) There aren't many brokers which offer high coverage of European small caps, so the returns you see might not be realistic.

2) The spreads can be high in small caps, especially on more obscure exchanges such as Portugal, Greece, Cyprus etc.

3) Brokers generally charge high commissions (ii charge £10 per trade) and some countries charge their version of stamp duty too (e.g. Spain).

4) If you want to invest in your ISA, you can't hold foreign currencies in them - so keep an eye on your conversion fees.

5) If you are investing in a taxable investment account or your SIPP, where you can hold foreign currencies, you may have a conundrum with how much of each and how many different european currencies you want to hold. I know some investors which trade european stocks, only trade those denominated in Euros, which of course excludes markets such as Norway, Switzerland etc.

Hope this helps as a starting point!