Summary:

- Morrisons is a supermarket and along with the other major UK supermarkets, it’s had a tough few years competing against the German discounters Aldi and Lidl.

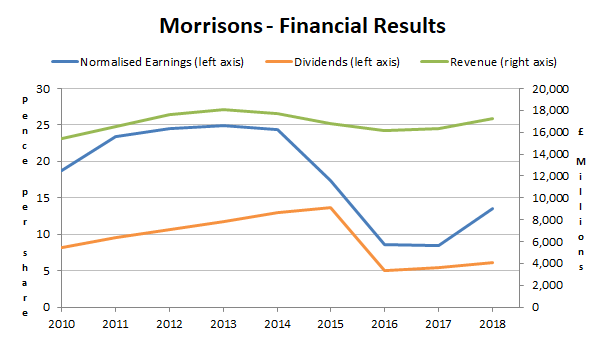

- Revenues, earnings and dividends fell, but are now starting to recover and grow.

- Morrisons’ dividend yield is low, suggesting high future dividend growth, but I think the market is probably overoptimistic.

10-Year growth rate: Below average

Morrisons is not a high growth company. Over the last decade its revenues, earnings and dividends have grown by an average of minus 7% per year, although that figure is slightly misleading.

It’s misleading because the period it covers happens to start at a high point for supermarkets and end at a low point.

If you look at periods longer than ten years then there is an underlying growth trend. It’s around a few percent per year and is likely driven by a combination of inflation and UK population growth.

Either way, Morrisons’ growth is below average, where the average growth rate of consistent dividend-payers is currently about 6% per year.

To be honest, this isn’t a massive surprise. Morrisons is a very mature business operating in an extremely competitive market. It’s also currently geographically constrained to the UK.

Going forwards, I would expect Morrisons’ growth to be no better than its long-term historic average of perhaps a few percent each year.

10-Year growth quality: Below average

Unsurprisingly, Morrisons’ below average growth rate leaves it with below average growth quality as well (where growth quality is basically a measure of growth consistency).

Over the last decade it has grown revenues, earnings and dividends approximately 67% of the time, while the average for consistent dividend-paying stocks is 73%.

This highlights the difficult time Morrisons has had as it struggles to cope with super-low prices from Aldi and Lidl.

This 67% growth quality score is also slightly misleading as Morrisons longer track-record is more consistent, as you might reasonably expect from a supermarket.

After all, it does operate in the defensive Food & Drug Retailers sector, so it should be relatively immune to the ups and downs of the economy.

And it is, but it isn’t immune to an attack from aggressive low-cost competitors whose business models perfectly fit the environment of post-crisis austerity Britain.

10-Year profitability: Below average

Here’s one of the key reasons why Aldi and Lidl were able to send shock waves through the supermarket sector…