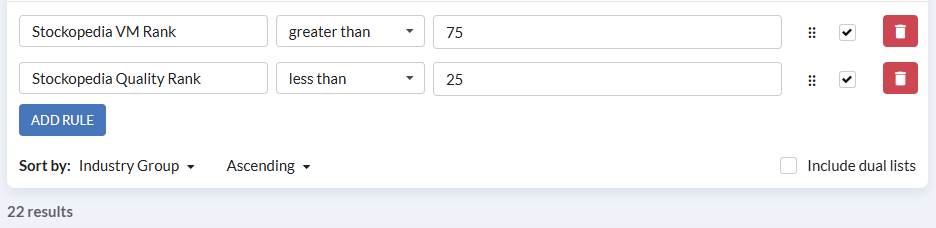

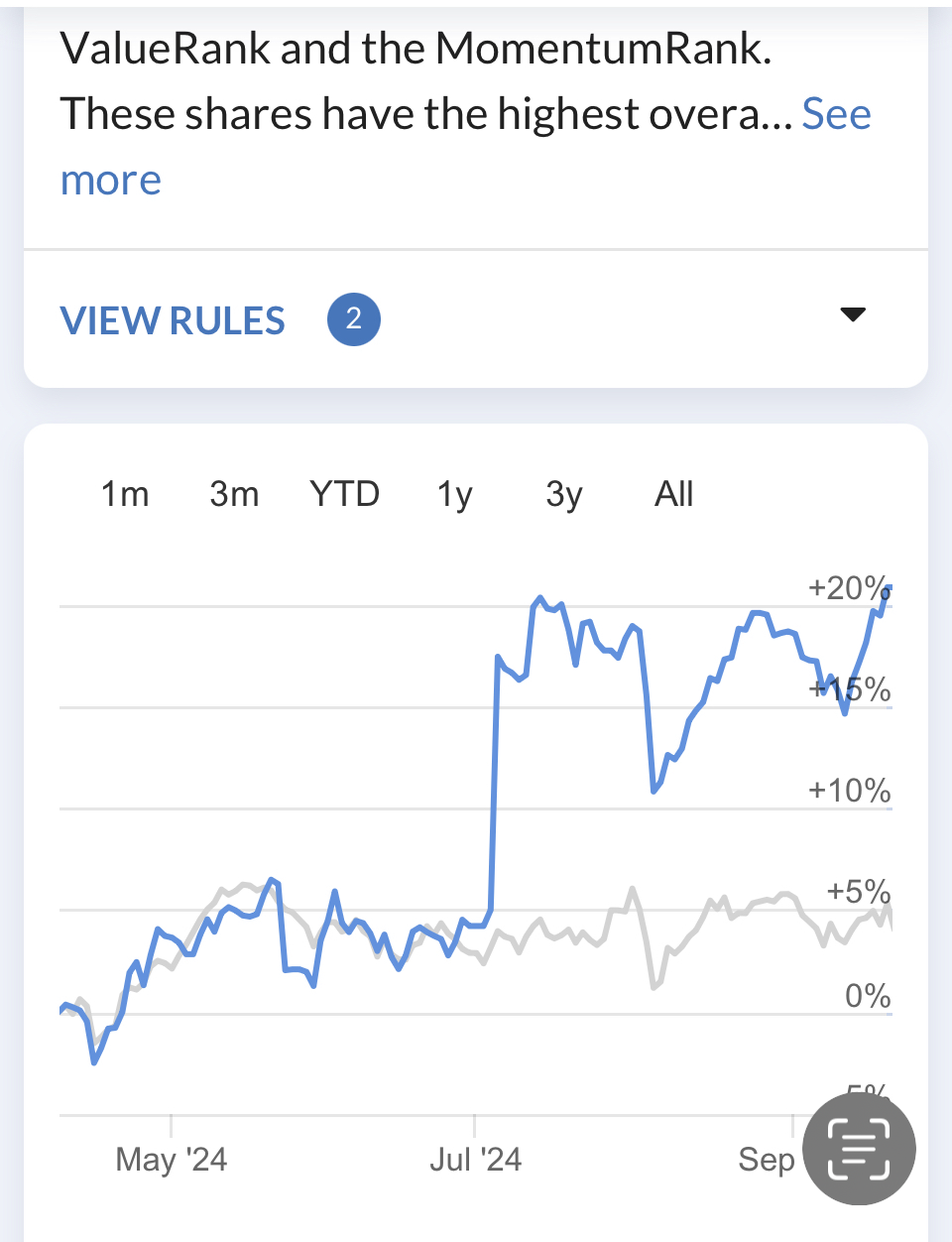

When I looked at improving the performance of the “crossover” Stock Styles, I asked why not just invest in Super Stocks? There were a few reasons, including the possibility of Super Stocks tending to cluster within specific sectors of the market at any given time. However, the most compelling reason for choosing a different winning style is that it is a better fit for our personalities. Those of us with a strong contrarian bent can struggle to buy stocks with strong enough recent gains to be Momentum winners. In contrast, investors who like to go with the flow often prefer the much higher Quality and Momentum Ranks that go with investing in High Flyers. Unsurprisingly, these styles are among the most popular with Stockopedia subscribers. However, there is a third, less-followed Stock Style, Turnaround Stocks. This is where companies score highly on the Value and Momentum Ranks but are low on the Quality Rank.

Why invest in Turnarounds?

On the surface, it seems a strange idea. Why would investors intentionally invest in companies that score highly on the Value and Momentum Ranks but poorly on the Quality Rank? After all, better quality companies are better, right? The answer has to do with how Quality is objectively measured. The academic literature tends to focus on three aspects: Profitability, Growth, and Safety. To avoid being influenced by short-term effects, practitioners tend to use longer-term measures, but how long-term is long-term? The tendency here is to use five years. This feels long enough to capture trends but short enough that the businesses are not so different as to be meaningless. The Stockopedia Quality Rank uses five-year measures of the following (together with a few other metrics):

- Average Return on Capital Employed

- Gross Profits to Assets

- Average Free Cashflow to Assets Ratio

- Operating Margin Stability

- Sales Growth Consistency

One of the challenges is that although it is well-known that corporate performance tends to mean-revert over periods of three years, some companies can take much longer to change direction. For those that do, the five-year measures may miss a business with positive attributes but going through an extended period of upheaval. This is why high-VM, low-Q stocks are classified as Turnarounds. This doesn’t mean every company with a low Quality score should be considered for investment. Looking through the list of low Quality Rank companies, they are typically the type of speculative dross that investors should give a wide…