Let's have a quick discussion on whether it's a time to be holding, buying or selling stocks.

Couple of good extracts from the Gartman Letter this morning:

SHARE PRICES ARE HIGHER... and they will be markedly higher as the day progresses, for the world has to understand that the monetary authorities in Europe are casting down any and all concerns about inflation and are instead responding to the concerns about “contagion” instead. New reserves... new cash... new stimulus is being pushed and will in the future be pushed into the banking system, and before that stimulus makes its way into the economy it shall make its way into equities. As we have said too many times previously, it is called a capital market for a reason, for capital that the central banks create finds its way into equity before it finds its ultimate way into plant, equipment and labour.

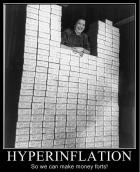

Being perhaps a bit too euphemistic, what we are seeing with the decision from its previous proscription against monetization and instead embracing it is what we shall call the “Zimbabwe- isation” of the global equity market. Remember that for a while, as the Zimbabwe dollar was plunging from near parity with the US dollar to trillionths of that value even as the Zimbabwe stock market was rallying monstrously, so too shall the equities markets around the world respond positively to this new monetary stimulus that the ECB is unleashing. Indeed, the trade probably is henceforth to own equities and to own gold in tandem, with one hedging the other.

There may be huge holes and flaws in the financial system, but the money is going to flow somewhere - GMO's Jeremy Grantham recently stated that there's a high probability of an equity bubble in the next 6 months ( Playing With Fire (A Possible Race to the Old Highs) ).

On the other hand - Alphaville reports that Marc Faber expects a 5-10% rally in stocks that he might use as a chance to open new shorts, while Citigroup says don't buy the dip.

The only certainty right now is a very high level of uncertainty - the game is certainly riskier - both to the upside and downside. We know that Tournesol went wisely into cash at the top - in the light of this massive bailout package should opinions now…