Speedy Hire (LON:SDY) are the market leader in providing equipment leasing services in the UK. The CEO splits those UK hire operations in 4 distinct segments; lifting, power, survey and general tools and equipment. Doing a quick 'first response' to that list points to their customers being companies related to construction, infrastructure investment and the like. That's an accurate appraisal, and takes us quickly from premise - the company has suddenly stopped performing as well as it has historically - to reasoning; they got dragged down as the boom turned to bust. Construction-related revenue accounts for 55% of this year's total - and that's coming down, says management.

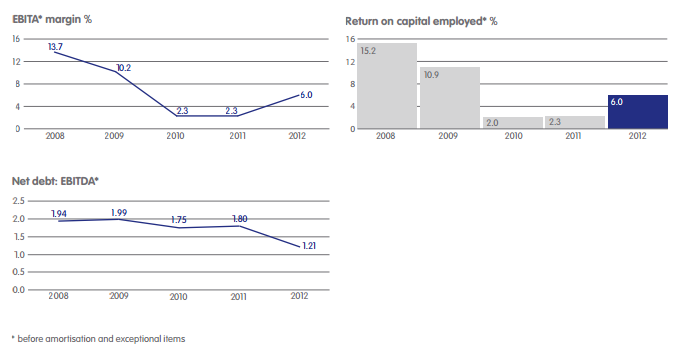

That idea in combination with the trends in the graph alongside means our potential value proposition is simple, then; the company is earning poor returns on capital, but historically hasn't done so. The current price may be an opportunity to buy a well positioned company (they are market leaders, after all) which is on its way out of the down point in the cycle. The risks are also equally obvious - though fiendish to quantify. The period pre-recession was, obviously in hindsight, rather a fantastic time for the clients Speedy Hire services. It's that old chestnut then; what can we call our baseline expectations for profitability?

This story is well told in the company's 2012 annual report, with three graphs highlighting how things have changed. While the EBITA margin cliff and RoCE tumble are obviously very bad news for investors, the net debt: EBITDA ratio isn't particularly worrying. This is a low figure, and in any case the metric doesn't take into account the enormous value of hire equipment on the balance sheet. From a lender's point of view I imagine Speedy Hire looks very safe, and if the lenders are happy then I'm happy they won't be poking and prodding. Even if the company never makes a profit again it can easily pay off its debts and have money left over for shareholders - all it has to do is run down its fixed capital and not replace it.

That's not what we really want, though; we want the company to return to its 2007 ways. From the looks of the breakdowns of cost on the annual reports, it appears the problem is just one…

.png)